The way consumers shop and purchase goods online are rapidly shifting and evolving. With online shopping sales in the US growing 14.5% in 2021 alone, more people are shopping online than ever. Previously, with cash payments unavailable while shopping online, you only had the option to pay with a debit or credit card to make purchases.

In the past several years, the payment methods have expanded to streamline purchasing, such as offering Apple Pay, Google Pay, or Paypal Checkout, and installment payment methods such as Affirm, Klarna, and Afterpay. Installment payments are the next wave of payment offerings in the form of “buy now, pay later” (BNPL) for consumers, giving retailers a more affordable option to purchase goods that may have been out of reach with more traditional payment methods.

Buy now, pay later payments function similarly to short-term loans, but offer consumers benefits such as softer credit checks and low to 0% interest rates. They are also available directly within the eCommerce checkout flow, whereas loans are a different, more varied process. There are more pros and cons to BNPL for consumers, which The Balance details here.

The BNPL market has quickly become a more than $100 billion industry, with companies worldwide now offering payments on credit for purchases small and large at online retailers. According to a report by Afterpay, 12% of online fashion retail purchases are through a BNPL provider. We cover the growing landscape of BNPL providers in our Buy Now Pay Later Ultimate Research Guide, but what’s next for the BNPL industry? Below we’re diving into what’s trending in the realm of BNPL.

Pay for experiences and services over time

While BNPL now accounts for 12% of all online fashion purchases in the United States, the landscape for products consumers can purchase with installment payments is fast increasing. Expect there to be more than just tangible goods available via buy now, pay later. Consumers will be looking for BNPL options for an increasing number of purchasable online goods and services, including vacation packages like Delta Vacations and online grocery delivery like Instacart.

With the flexibility of payments over time, offering buy now, pay later for experiences like concert tickets and hotel rooms allows the opportunity for an alternative to traditional personal financing options such as credit cards which may be associated with higher monthly interest rates. In addition, vacations or experiences could be perceived as more attainable when not having to pay for everything at once upfront. Expect to see the availability of installment payments for more than tangible goods increase over the next year as popularity in BNPL grows.

The risk for fraudulent purchasing with a BNPL would most likely increase when no tangible goods are exchanged. Therefore, accurate and reliable identity verification becomes ever more apparent when experiences are now available with BNPL.

A little note about us: As an anti-fraud API provider, we work with both BNPL businesses and eCommerce companies that leverage this technology. The industry also has its fair share of fraud challenges. So, we think it’s helpful to understand how companies are open to fraudulent techniques, how you can protect your company, and how a service like Fingerprint can help you stop fraud before it starts.

The BNPL shopping marketing community

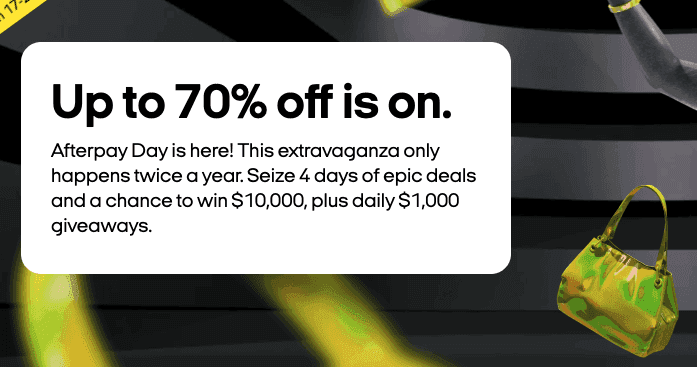

How do consumers find out which stores offer a buy now, pay later option? Most of the time, it’s through the retailer’s marketing efforts. However, BNPL providers are offering their own marketing efforts and the opportunity to shop through their sites and mobile applications, such as Klarna, to help boost sales for their customers. Another example is Afterpay’s recent promotional “Afterpay Day,” similar to Amazon’s well-known Prime Day, where retailers offered special and exclusive offers only available to shoppers purchasing with Afterpay.

Additionally, the ability for retailers to offer multiple installment payment providers at checkout creates flexibility for the consumer and creates a new marketing opportunity for retailers. By being listed on each provider’s marketplace, retailers can acquire new customers, make more loyal repeat customers, and benefit from partnering with well-known BNPL providers. As a result, more and more retailers will join in on the BNPL offerings this year, making the marketplace aspect more crucial and valuable to increasing sales.

“Shop now, pay later” - shifting marketing strategies for retailers

Retailers may not advertise in their email or social media marketing campaigns that they offer pay by credit card. However, a BNPL option may be less obvious to consumers and worth including in ongoing marketing campaigns. Many consumers are still warming up to using a buy now and pay later at checkout, and many retailers have yet to offer it as a payment option.

As a retailer, including it in your marketing on social media, a feature on your website, paid advertising, or email marketing could help boost awareness of flexible payment options on your site. This could also result in customer acquisition of new customers that chose to shop on a site because it offers a BNPL option. And data shows that customers who use BNPL are more likely to become repeat customers on sites that offer their preferred BNPL.

That could seem overwhelming to retailers who already have many other campaigns running. Good news is that some buy now, pay later providers offer resources for retailers to help remove the burden of getting up to speed on how it works, marketing opportunities, and proper branding guidelines. Affirm and Afterpay are just two examples of providers with dedicated retailer resources for launching, marketing ideas, and continued training.

Source: Purlisse Marketing Email

Buy now, pay later repeat customer rewards and incentives

As we mentioned in the last section, consumers who use buy now, pay later are more likely to use it again and again, creating an ecosystem of loyal and active repeat customers. We also mentioned earlier that it’s becoming easier for consumers to discover more brands and stores that offer specific BNPL providers through a provider's shopping marketplace.

Providers, like Klarna, reward their customers who pay via Klarna with a new rewards program. Like traditional loyalty programs, consumers who shop and pay with Klarna get rewarded with points for each dollar spent can then redeem at many retailers. The benefit for consumers is that picking a preferred provider for their BNPL payments means potentially reaping benefits in the longer run.

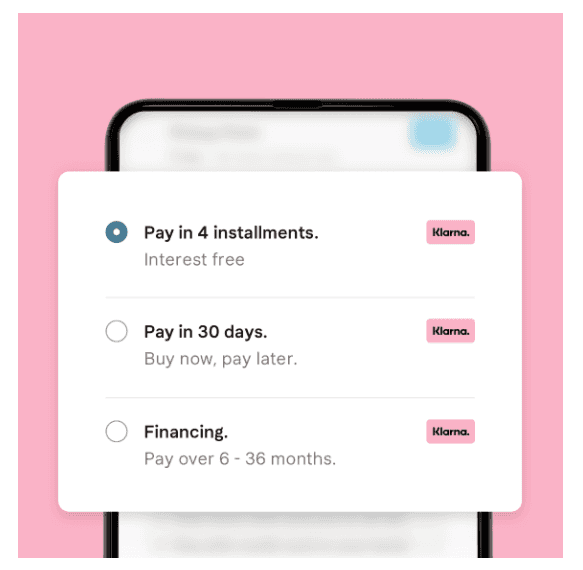

Even more flexible payment offerings

The idea of “pay in four” or pay over a short amount of time (such as six weeks) drove the initial surge of popularity in buy now, pay later purchases and offerings. But, as these BNPL companies grow and continue to see billion-dollar annual successes, the ability to offer even more flexible payment options, such as longer term financing or 0% interest rates, increases. Take the example below from Klarna’s website for businesses, where the ability to offer more than one kind of buy now, pay later is available to retailers to drive BNPL revenue and help drive retailer revenue.

Buy Now, Pay Later for Invoices

As we mentioned earlier in this post, the ability to purchase with buy now, pay later is expanding past consumer goods like beauty products and exercise equipment. There’s also a growing trend to help solve the disruptive process of invoiced payments. Solutions to this problem, like Biller, help bridge the gap between suppliers and purchasers by helping make sure invoices are paid in full and on time with a buy now, pay later mindset. As a result, we expect to see innovative solutions to longstanding financial frictions like invoices continue to emerge over the next few years.

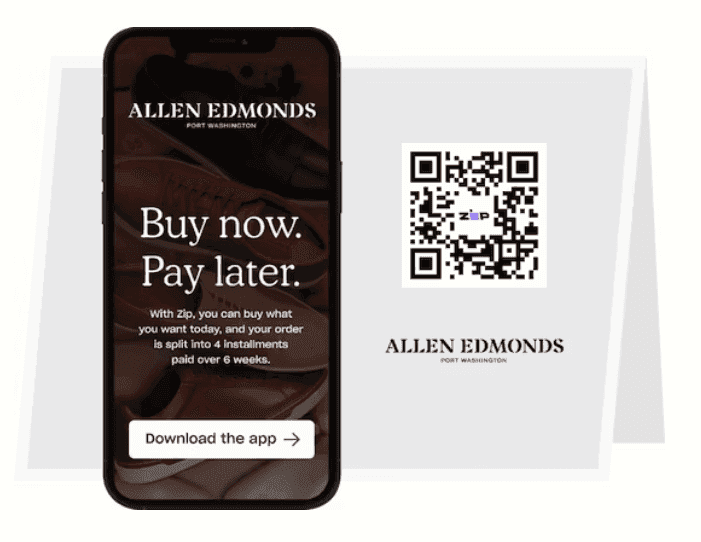

Brick and mortar buy now, pay later

Online shopping is what originated the digital buy now, pay later shift in shopping experience. But as economies continue to see pre-pandemic activities, such as in-store shopping, offering more flexible payment options in-store such as buy now, pay later will become more popular for consumers to expect from a brick and mortar shop. For example, one buy now, pay later provider, Zip (Example show below), offers in-store BNPL installment payment options via a quick QR code scan at the register.

With all the growth witnessed within the buy now, pay later industry, one thing is sure: this industry will only grow further over the next few years. That growth has alerted government agencies to help better regulate how BNPLs function and their lending practices, which is currently in review by the US government. However, even with some expected change, consumers remain highly optimistic about the purchasing power that comes with the ability to pay in four or pay over time rather than all at once.