Account takeover Articles

March 31, 2025

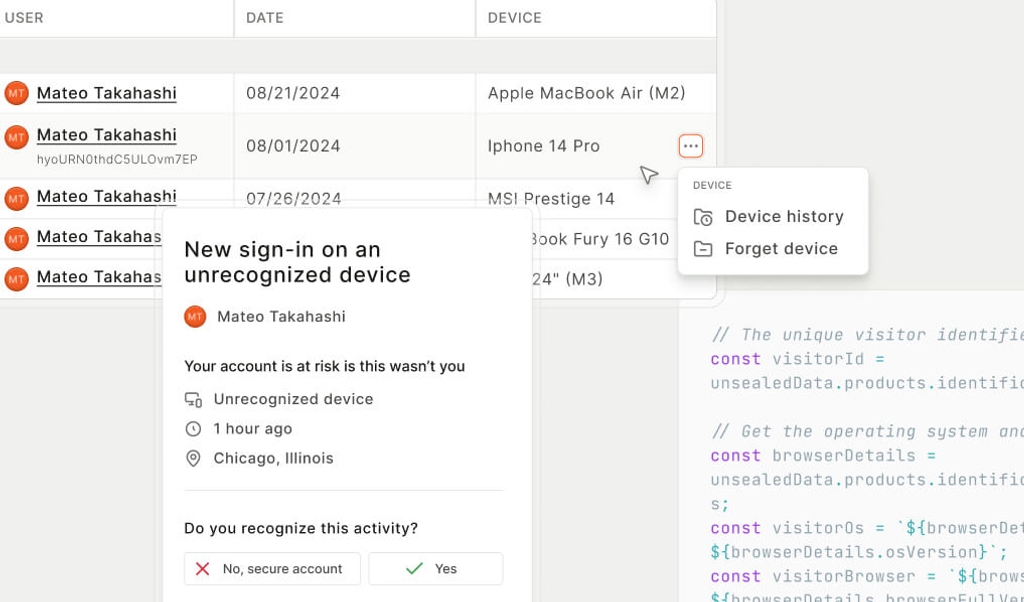

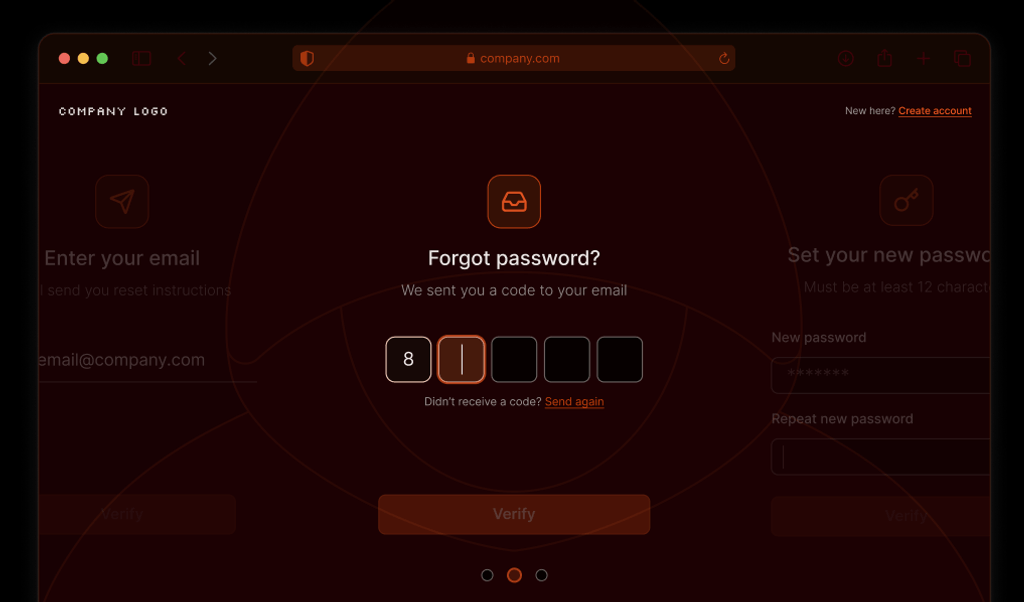

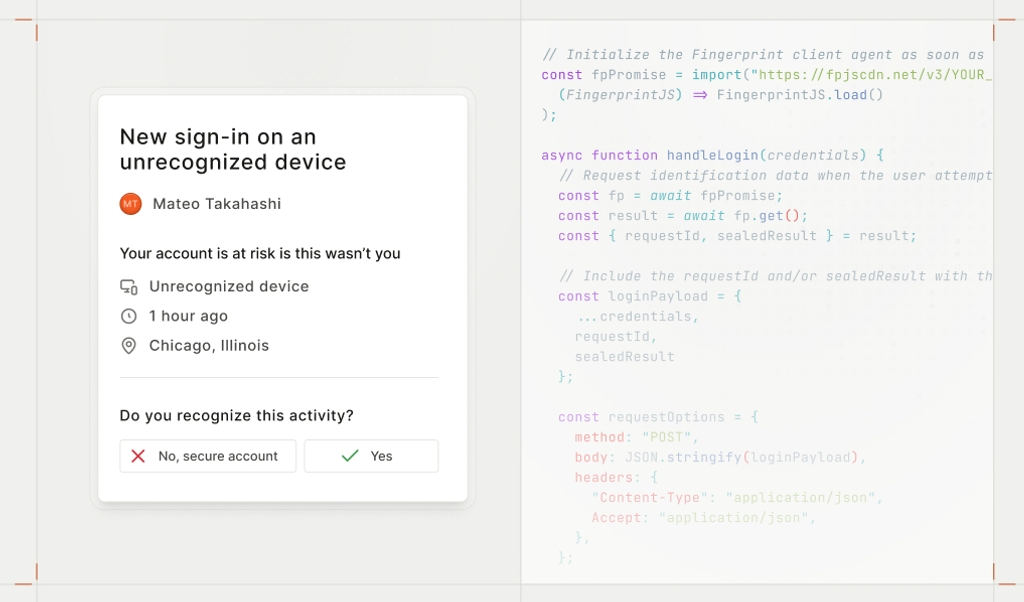

Tutorial: Power fraud detection with real-time user insights for Recent Devices pages

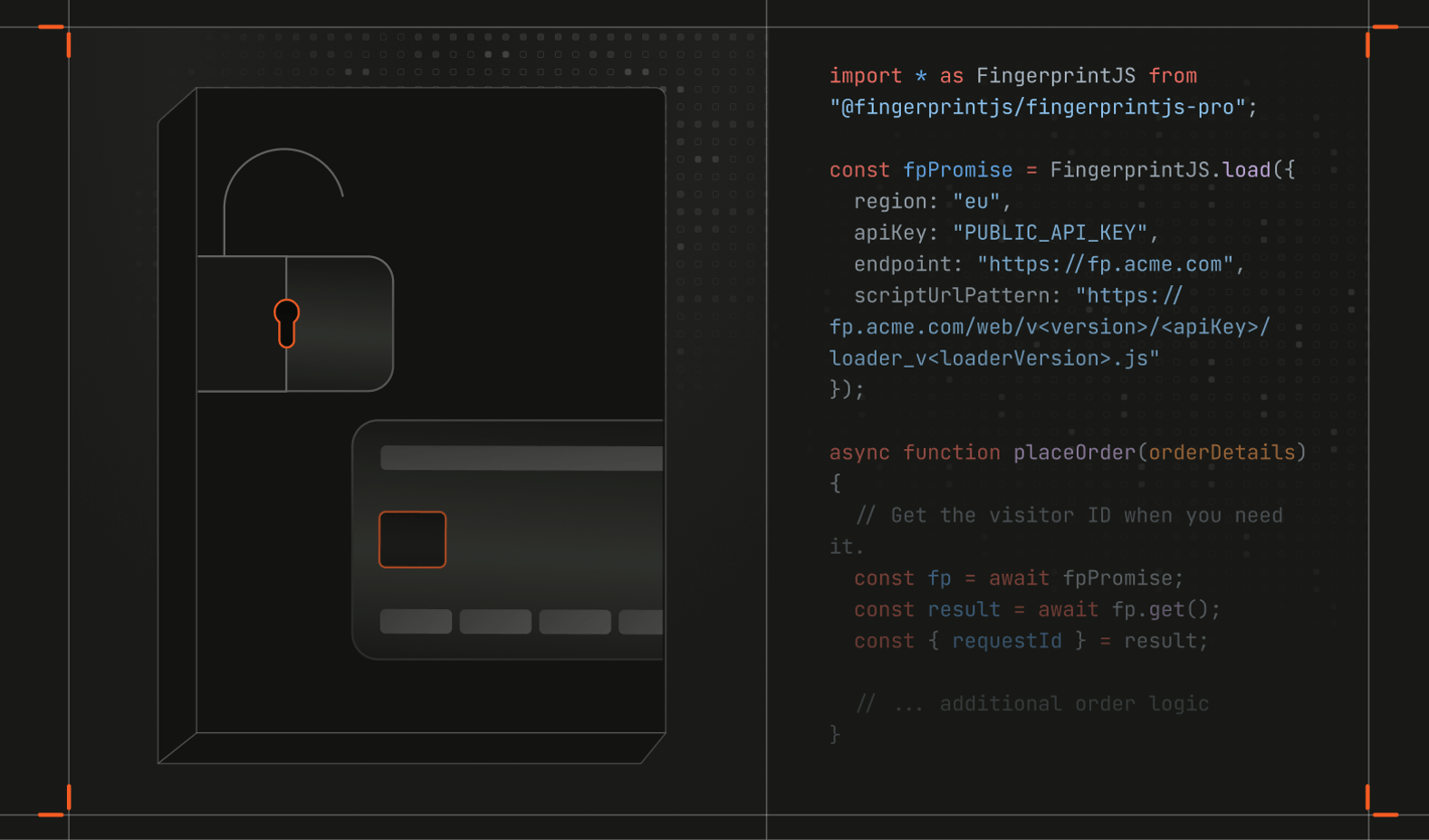

Learn how to integrate Fingerprint’s device intelligence platform to create informative “recent devices” pages with real-time user insights. Step-by-step tutorial with code snippets for seamless setup.

- Tutorials

- Account takeover