Anti Fraud technology Articles

March 24, 2025

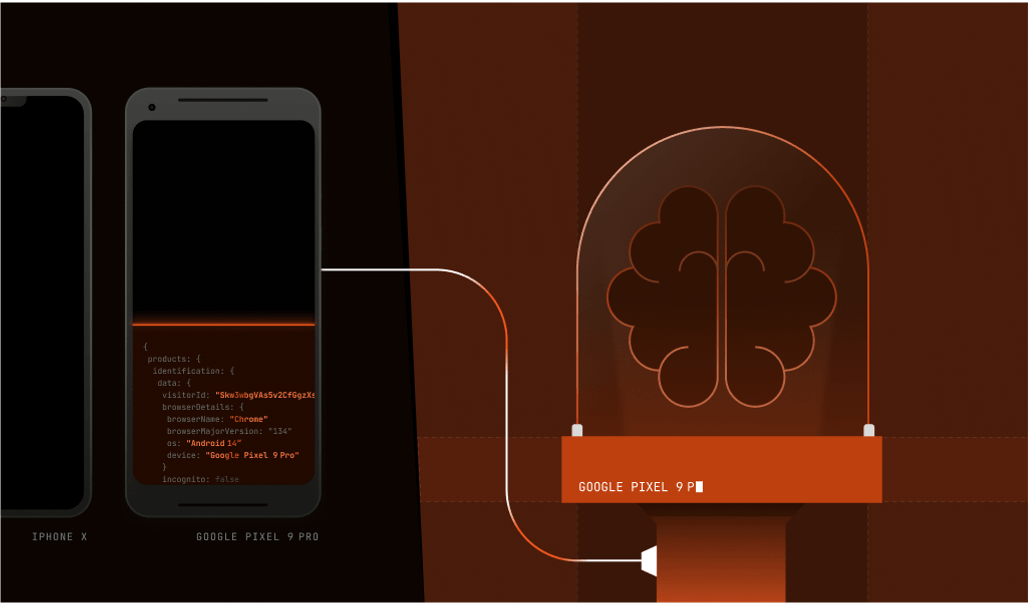

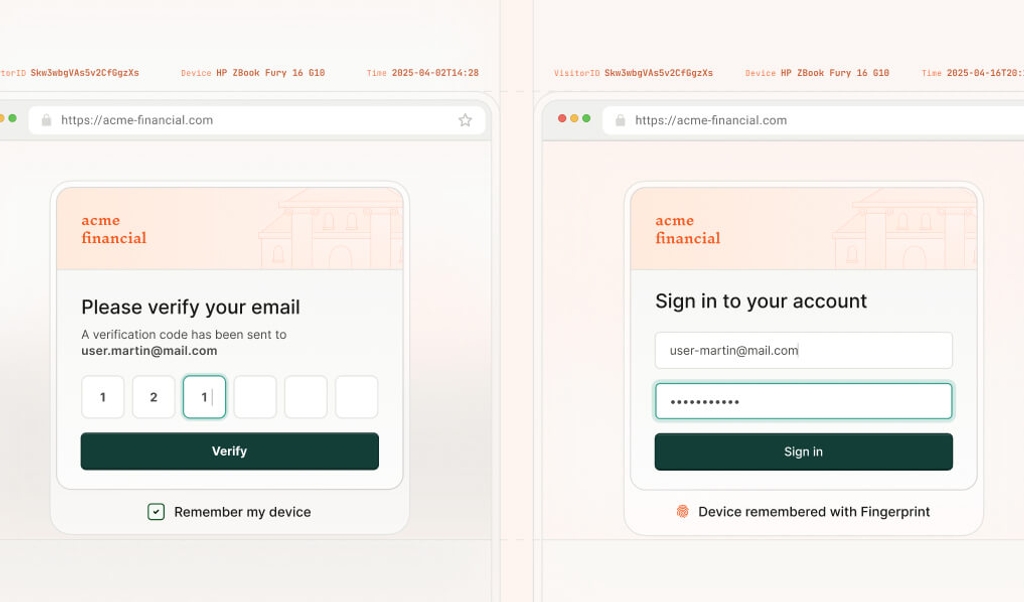

How to meet geolocation requirements for regulatory compliance

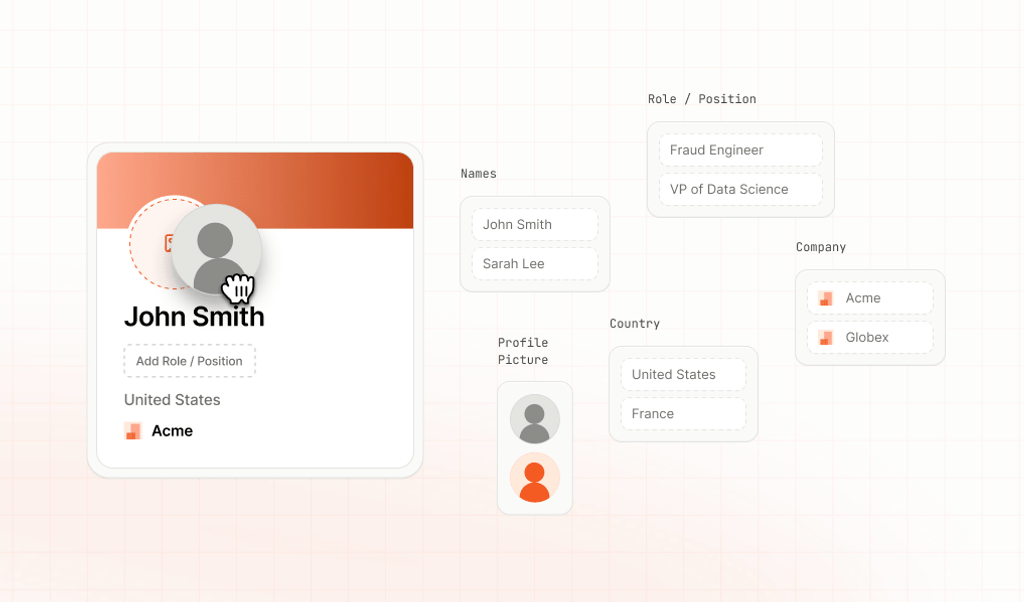

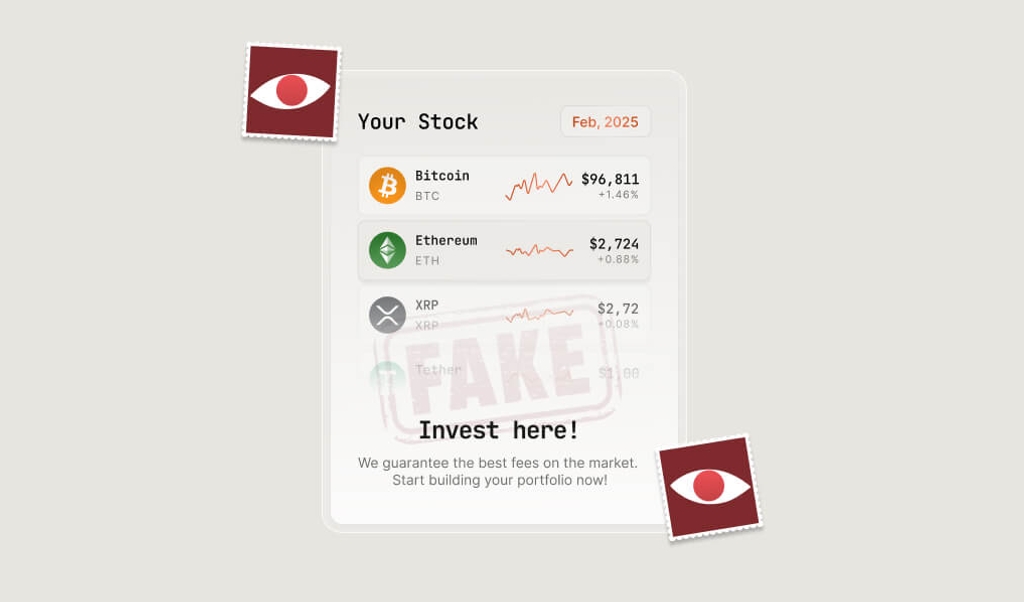

Complying with geographic restrictions can be a headache. Learn how device intelligence exposes location spoofing techniques, revealing users' true locations, and helps businesses meet regulatory requirements while avoiding penalties.

- Anti Fraud technology

- Kyc