Payment fraud Articles

June 27, 2025

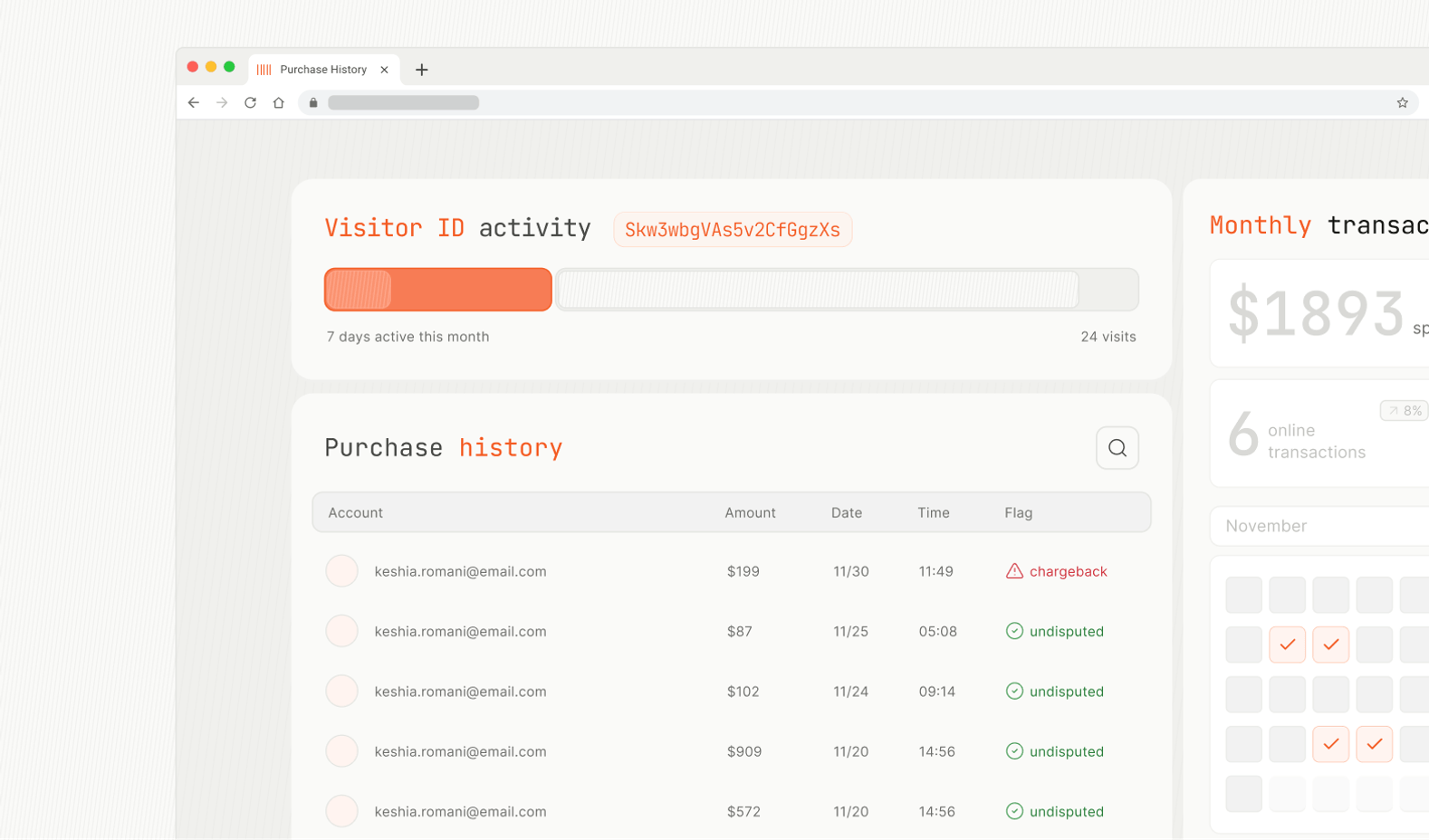

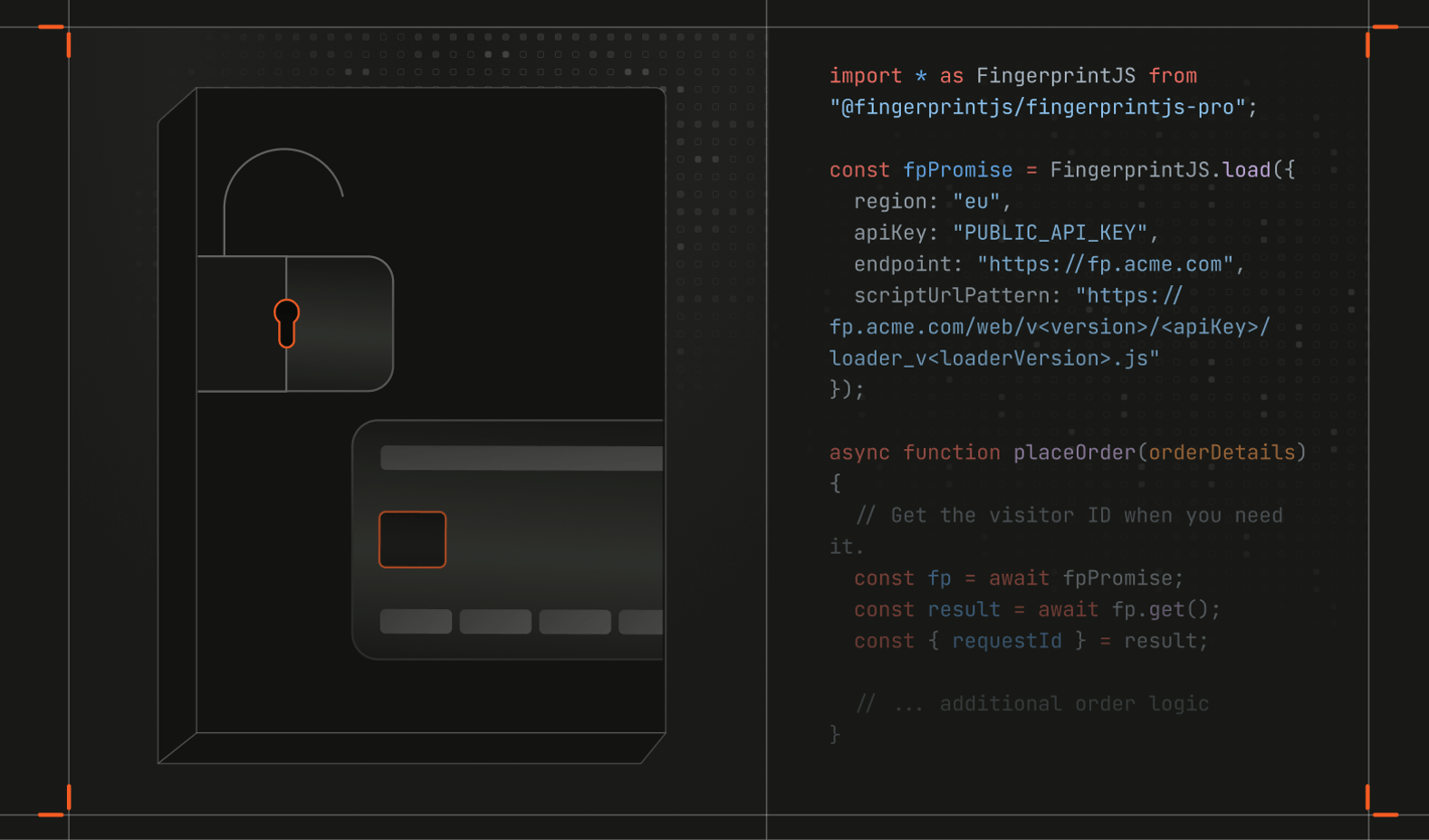

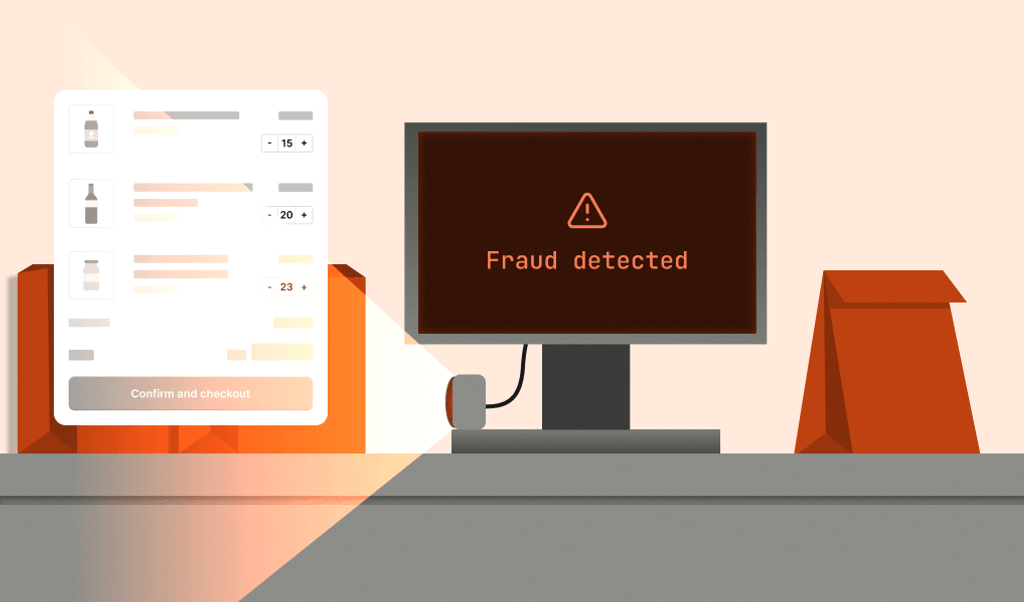

Guest checkout fraud: How to stop repeat offenders

Allowing guest checkouts boosts conversion rates but also opens the door to repeated anonymous payment fraud. Learn how to detect and stop fraudsters while maintaining a seamless experience for legitimate shoppers.

- Ecommerce fraud

- Payment fraud

- Tutorials

May 15, 2025

How to use Compelling Evidence 3.0 and device intelligence to minimize penalties under Visa’s VAMP

Chargebacks are even more painful under Visa's new rules. Learn what's changed and how you can stay below tightening chargeback ratios and enumeration thresholds.

- Ecommerce fraud

- Payment fraud