Summarize this article with

What is multi-accounting & how is it different from normal use?

Multi-accounting is the act of a single person creating and controlling multiple accounts on an online platform, typically to bypass platform rules or secure advantages not intended for them. Unlike standard user behavior, where one account belongs to one individual, multi-accounting is where one person poses as many.

For fraud prevention teams, multi-accounting presents a persistent challenge. It distorts analytics, undermines community trust, and directly enables fraud. When a user manipulates systems designed for individuals — such as referral programs, voting mechanisms, or bonus offers — the result isn’t just lost revenue. Data becomes unreliable, and compliance risks grow.

In short, multi-accounting erodes the trust and fairness that online businesses need to thrive.

Industries that feel the pain of multi-accounting

No industry is immune to multi-accounting, but some feel its impact more sharply.

- Gaming and gambling: Fraudsters create multiple accounts to farm rewards, collude to manipulate ranking systems, or exploit bonus offers meant for genuine new users. This drains profits and promotional budgets, and cause legitimate players who drop off after seeing unfair competition.

- Fintech: Multi-accounting enables synthetic identity fraud, lets users dodge transaction limits, and can open the door to money laundering. For businesses under strict regulatory oversight, these risks can lead to penalties and lasting reputational harm.

- Streaming and subscription services: Illegitimate users may set up numerous accounts to take advantage of free trials or bypass regional content restrictions, cutting into revenue and complicating licensing agreements.

- Marketplaces and review-driven platforms: By controlling multiple accounts, fraudsters can inflate product ratings (also known as review fraud), skew pricing and bidding, or damage competitors. Survey and research companies deal with similar issues because a handful of bad actors can bias results and harvest incentives meant for authentic participation.

All these industries depend on the idea that one account equals one person. When that assumption breaks down, the foundation of trust that supports these platforms is shaken.

How attackers hide their tracks when creating multiple accounts

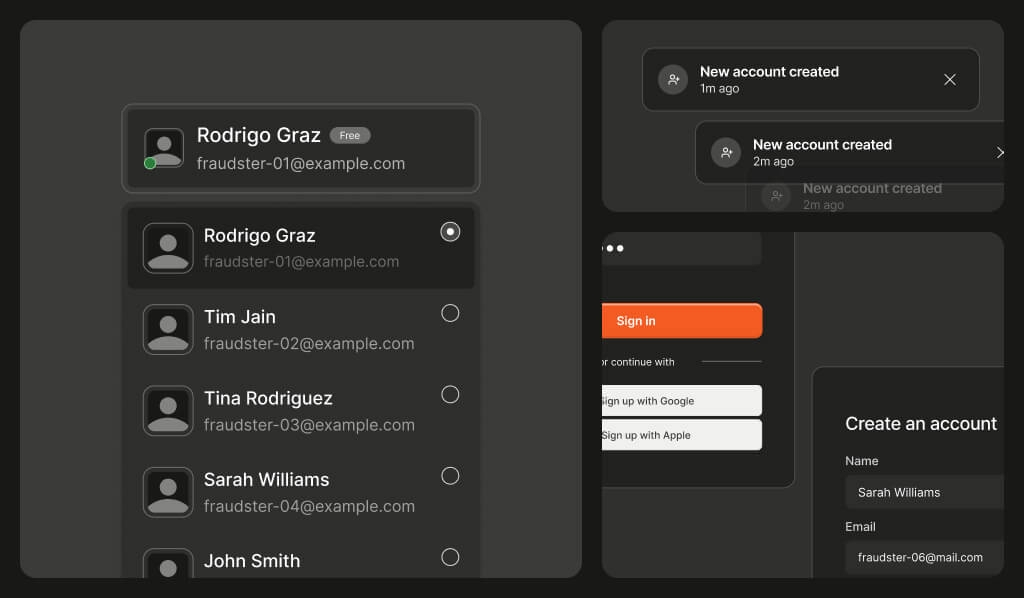

Fraudsters continually evolve their methods to avoid detection, and multi-accounting is no exception. One common tactic involves device farms: Large collections of physical or virtual devices designed to mimic unique users. By cycling through these devices, attackers create the illusion of a diverse user base.

Anti-detect browsers add another layer of complexity. These specialized browsers randomize or spoof browser attributes, making it much harder to recognize when the same underlying environment is reused. When combined with virtual private networks (VPNs) and proxy networks, fraudsters can further obscure their locations, simulating global distribution or sidestepping IP-based controls.

Stolen credentials are a staple in the fraudster’s toolkit. Through credential stuffing attacks, bad actors gain access to dormant or legitimate accounts, making it even harder to distinguish between real and fake users. The interplay of these tactics creates scalable, resilient fraud operations that keep prevention teams on alert.

Signals to detect multi-accounting

The good news is that multi-accounting leaves a technical footprint — if you know where to look.

- Device intelligence: By collecting and analyzing a wide range of browser, operating system, and hardware attributes, platforms can generate persistent, highly unique identifiers. Even if a user clears cookies, switches networks, or browses in private mode, device intelligence can often recognize when the same device is used across multiple accounts.

- IP reputation and geolocation: Platforms can determine whether requests come from known datacenter proxies, anonymous VPNs, or suspicious geographic regions. Sudden surges in account registrations from a single IP address or a device that appears to travel the globe in minutes can quickly raise red flags.

- Behavioral analysis: By examining interaction patterns — such as mouse movements, typing rhythms, or navigation flows — fraud teams can identify the subtle signs of automation or unnatural speed.

- Velocity: By monitoring how many accounts are created from the same device, IP, or fingerprinted attribute within a short window, teams can identify spikes that don’t fit normal user behavior. For instance, a device registering dozens of accounts in rapid succession is a classic indicator of fraud.

Each of these methods offers a unique perspective, but they’re most effective when combined. Together, they form a layered defense that makes it much harder for fraudsters to evade detection.

How device intelligence serves as a secret weapon against multi-accounting

At Fingerprint, our team approaches multi-accounting with highly accurate device intelligence. We use more than 100 signals across browsers and devices to generate a unique visitor identifier for every user. This goes far beyond simple cookies or user agent strings. By analyzing a rich set of attributes — from installed fonts to screen resolution and browser quirks — we can reliably recognize returning devices, even when fraudsters attempt to cover their tracks.

What sets our solution apart is the addition of more than 20 Smart Signals, each providing real-time context about device and network behavior. For example, Bot Detection identifies automated browsers like Selenium or Puppeteer, while VPN Detection reveals when visitors are masking their true IP addresses. Velocity Signals bring attention to unusual bursts of activity, such as a single device traveling across multiple countries in a short period. Other signals, such as Browser Tampering Detection, Incognito Detection, and Emulator Detection, add further context to the risk profile of each visitor.

By integrating device intelligence and Smart Signals into your fraud prevention workflow, you gain the ability to surface multi-accounting attempts as they happen. This empowers your team to enforce limits and protect promotions while ensuring honest users are not mistakenly flagged.

Build a multi-accounting defense that works

Multi-accounting is always evolving, but with the right combination of tools and strategies, you can stay ahead. Our experience shows that the most effective approach blends persistent device intelligence, real-time signals, and adaptive actions. This layered defense allows fraud teams to block fraudulent accounts while keeping the experience smooth for legitimate users.

If you want to see how device intelligence and visitor identification can strengthen your fraud prevention efforts, you can start a free trial or connect with our team to discuss your specific challenges.

Ready to solve your biggest fraud challenges?

Install our JS agent on your website to uniquely identify the browsers that visit it.