Summarize this article with

“How do we handle fraud?” is a fundamental question for any retail business. For the e-commerce platforms that are building payment and shopping infrastructure to support thousands of online merchants worldwide, this question becomes even more complex.

These platforms sit at the center of billions of transactions, with hundreds of shops and sellers to support, and projected sales are expected to surpass $6.8 trillion in 2025 globally. Activity is nonstop and every site visit, product interaction, and checkout is a safety priority, while still needing to keep the experience fast and easy for legitimate users.

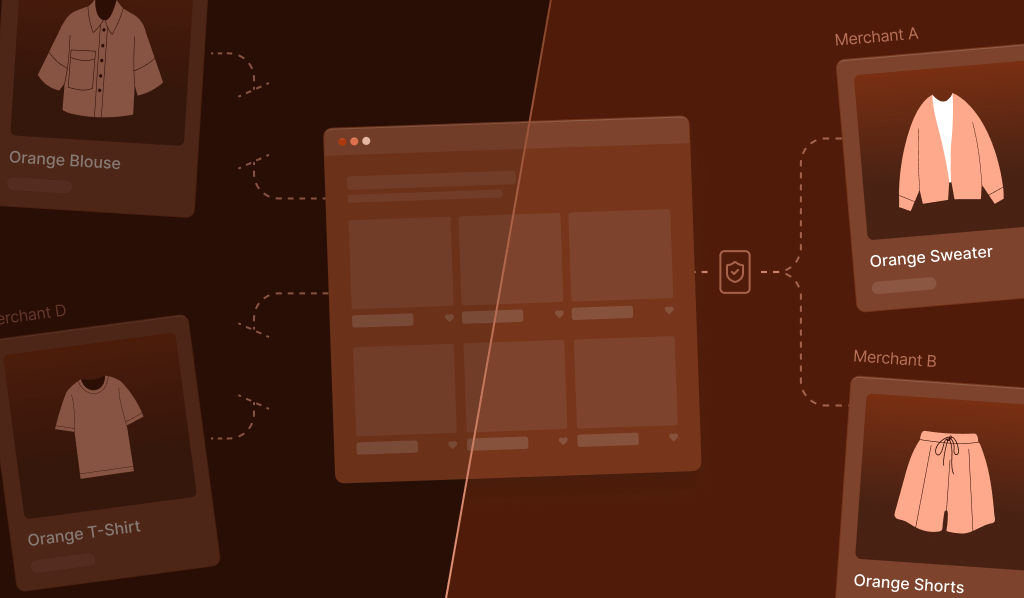

Yet when it comes to fraud prevention, it’s often been up to individual shops and merchants to fight fraud on their own. They may deploy fragmented tools and tactics, with limited or no visibility into broader threat patterns and malicious activity. The result is an ecosystem where sophisticated bad actors can move across merchants without ever being detected.

However, the most innovative e-commerce platforms today aren’t asking merchants to act as individual security experts any longer. Instead, they embed fraud prevention and protection as a core capability in their platform, making it invisible to legitimate shoppers and automatic for their sellers.

A unified, platform-level approach to stopping fraud

Payment systems like Shopify Payments, Shop Pay, WooPayments, and integrated checkout APIs are all under constant attack from fraudsters. Bad actors use stolen cards, synthetic identities, and automation tools to test for any weaknesses. As fraud sophistication rises, the challenge is in shifting from a reactive posture to a more preventive approach.

Too often, merchants are defending their business from fraud in silos, unable to see higher-level patterns or repeated attack attempts. A fraudster blocked by one store may simply move to the next, with each merchant unaware of their prior attacks and malicious activity.

Real-time device intelligence at the platform level changes the equation. By identifying devices across sessions and merchants, teams can offer truly platform-level fraud defense.

If you’re able to identify the same stolen card being tested across dozens of shops, or the bot network that’s systematically abusing promo codes, or the same account takeover ring that is trying to hit a different merchant every week — then you can stop these fraudsters at the source, and curb attacks across multiple merchants within your platform

Fraud defense as a value-add to merchants

For payment platforms and merchant ecosystems, device intelligence represents more than a security upgrade for their users. It’s a value-add feature that their merchants can depend on from day one.

By integrating real-time device signals into checkout flows, payment decisions can be both safer and faster. Merchants benefit from lower cart abandonment rates, reduced chargebacks, and greater visibility into known threats and risks to their business.

In essence, this approach creates a powerful fraud-prevention flywheel. As more merchants participate, the platform gains richer, sharper risk insights that can be used for stronger collective protection. Fraud defense becomes a platform advantage, and no longer an individual merchant burden. Meanwhile, the platform benefits by reinforcing its reputation for reliability, security, and trust.

Changing the e-commerce security equation

With a global vantage point across buyers, sellers, and transactions, e-commerce platforms have a unique ability to map and identify suspicious patterns across all that activity. Yet this is only possible if they have clean, real-time device data as inputs for their fraud engines.

Cleaner and more accurate device-level data is necessary in order to build stronger, scalable, platform-level fraud prevention capabilities. With persistent, real-time device intelligence, fraud teams can link risky devices and behaviors to specific accounts at the platform level, and it’s far easier to stop account takeovers (ATO), limit chargebacks, and prevent refund and promo abuse.

This changes the security equation entirely. You can start asking more questions like:

- Has this device been associated with confirmed fraud anywhere on our platform?

- Does this behavior match patterns we've seen from bot networks or synthetic identities?

- Is this the same bad actor who attempted account takeover on three other merchants this week?

The device intelligence difference

Device intelligence allows platforms to create a continuous thread across every interaction. When a customer shops and transacts at different merchants, you can use their unique signals and IDs to employ a number of effective fraud prevention techniques across the entire ecosystem.

For example, with platform-level device intelligence, you can:

- Link risky devices across merchants. That clean-looking first-time customer at Merchant B? That same device initiated fraudulent chargebacks at three other stores last month. Block them before the transaction completes.

- Detect automated fraud at scale. Bot networks leave trails, whether it’s unusual browsing patterns, impossible geographic traits or transaction velocities, or synthetic behavioral signals. When these patterns emerge, you can thwart malicious bot actions at the source.

- Stop account takeovers and credential abuse. Credential stuffing doesn't impact one merchant. Fraudsters sweep through your platform, testing stolen username/password combinations wherever they work. Platform-level device intelligence spots the attack vector early and protects all your merchants simultaneously.

- Eliminate promo fraud. Fraudsters may attempt code exploits multiple times across multiple shops. You can put a stop to this at the source, which means more sales and more accurate analytics.

- Reduce chargebacks. Minimize the headache of fraudulent charge disputes. Merchants can lower refund costs, see cleaner accounting, and strengthen their brand reputation.

- Authenticate legitimate transactions faster. Visitors with strong trust signals can move through checkout with minimal friction, which can help boost conversions and turn returning users into loyal customers.

Unlocking more growth through trust

Persistent device intelligence at the platform level creates a shared layer of signals and risk insights that protects every merchant while keeping checkout experiences fast and private for legitimate customers.

With unified detection across all merchants, platforms can cut unnecessary declines, block account takeovers and promo abuse earlier, and support higher conversion with less friction. This creates a more trusted environment where merchants can grow without carrying the burden of fragmented fraud tools.

For more information on how Fingerprint can strengthen platform-wide fraud defenses and help you unlock more growth through trust, visit our e-commerce page.