Summarize this article with

Online payments are a playground for fraudsters. Every time someone enters card details or clicks “Pay Now,” there’s a chance the person behind the screen isn’t who they claim to be. Payment authentication is a critical barrier between your business and a flood of unauthorized transactions, chargebacks, and regulatory headaches. If you’re running a fintech, e-commerce, or SaaS platform, payment authentication is fundamental to secure, trustworthy payment flows.

Why payment authentication matters

Online transactions are a favorite target for fraud. Without verifying both the payment details and the person using them, anyone with stolen credentials or a bit of technical skill can drain accounts, make fraudulent transactions, or exploit weak points in your checkout flow. Payment authentication acts as the gatekeeper, confirming that each transaction is legitimate and is coming from the real customer.

Customers expect secure, trustworthy payment experiences. Regulators require strong customer authentication in many regions. And your fraud team? They’d rather prevent bad transactions than clean up the mess afterward.

How payment authentication works

Payment authentication ensures that a transaction is being made with a valid payment method by the person authorized to use it. This includes two parts: confirming the payment instrument itself (such as a card or digital wallet) and verifying that the person initiating the transaction is legitimate.

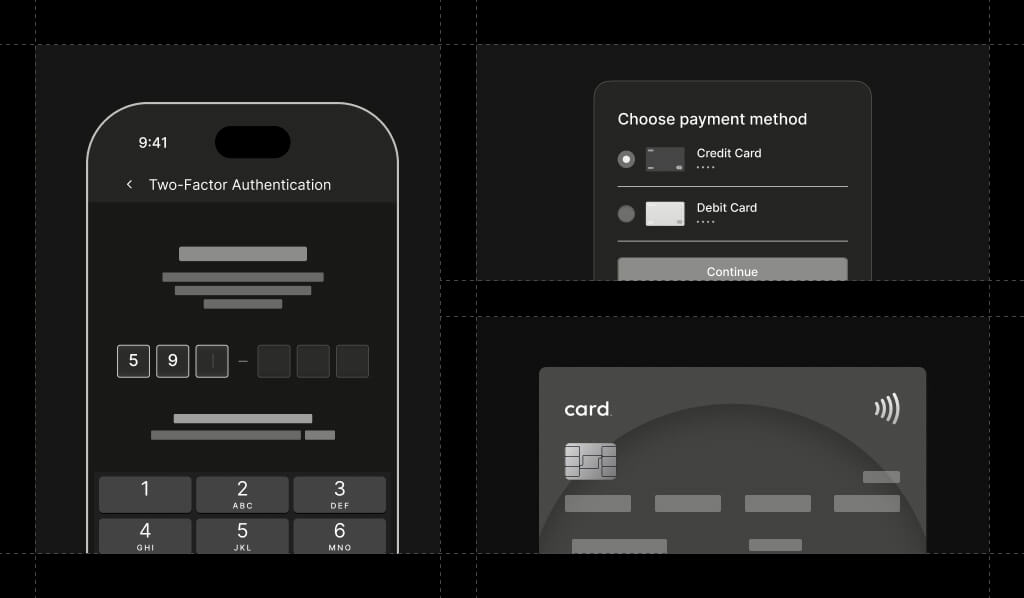

User authentication often relies on a combination of factors:

- Something the user knows, like a password or PIN

- Something the user has, such as a phone, token, or card

- Something the user is, like a fingerprint or face scan

Most secure payment systems require at least two of these. This layered approach makes it much harder for attackers to succeed using stolen details alone.

Common payment authentication methods

3D Secure (3DS)

If you’ve ever been redirected to your bank’s website during checkout, you’ve met 3D Secure. This extra layer used by Visa, Mastercard, and others is designed to catch fraud before it happens. 3DS prompts the user for a password, one-time code, or another proof that they’re legitimate. While the original 3DS could be clunky, newer versions like 3DS 2.0 use risk analysis to challenge only the riskiest transactions.

Multi-factor authentication (MFA)

MFA goes beyond passwords. Now, you might need to tap “Approve” on your phone, enter a code sent by SMS, or use a hardware token. The idea: even if one factor is compromised (say, your password), the fraudster still faces another barrier.

Biometric checks

Modern payment apps love biometrics. Scanning a fingerprint or face is fast, hard to fake, and convenient. This “something you are” factor is everywhere from Apple Pay to banking apps, offering strong security without the hassle of remembering yet another password.

Device-based approaches

Device intelligence is a powerhouse in payment authentication. By analyzing the device used to make a payment — its configuration, behavior, and history — platforms can spot when something doesn’t add up. Recognized devices might breeze through, while suspicious ones get flagged for extra scrutiny. While not an explicit authentication factor, device intelligence assesses the risk of a transaction based on device traits and behavior.

Tokenization

Tokenization replaces real card details with a unique code that’s useless if intercepted. It’s used in mobile wallets and secure checkout flows to protect sensitive data without slowing down the payment. Tokens are often tied to a specific device or merchant, helping confirm the source and adding an extra layer of trust.

Regulatory requirements: PSD2, SCA, and beyond

Regulators aren’t joking around when it comes to payment security. In the European Union, the Revised Payment Services Directive (PSD2) raised the bar with Strong Customer Authentication (SCA). SCA requires at least two independent authentication factors for most electronic payments, so your “something you know, have, or are” model isn’t optional; it’s required.

Other regions have their own rules, but the trend is clear: regulators expect robust authentication, and you’re expected to keep up. If your business operates across borders, your authentication strategy needs to adapt to local requirements or risk fines and unhappy customers.

How authentication blocks payment fraud

Fraudsters love weak authentication. They can slip in, use stolen cards, or take over accounts with minimal resistance. Strong payment authentication shuts the door on:

- Card-not-present fraud: Verifies that the online shopper is the real cardholder, not just someone with a stolen number

- Account takeover attacks: Even if a fraudster has login credentials, multi-factor checks can block access

- Chargeback abuse: With a clear authentication trail, you’re better equipped to dispute fraudulent chargebacks

- Promo abuse: Prevents fraudsters from creating fake accounts to exploit promotional offers

Balancing security and user experience

The problem is that while every extra authentication step can block fraud, it can also risk annoying your real customers. Make things too strict, and people abandon their carts. Make things too easy, and fraudsters stroll in.

Risk-based and adaptive authentication are the answer. Instead of treating every transaction the same, these systems adjust the level of scrutiny based on risk. If someone’s using a recognized device from their usual location, let them through with minimal fuss. If something feels off — new device, unusually high-value purchase, or known fraud signals — ramp up the authentication.

Device intelligence plays a big role here. By silently analyzing device attributes and behavior in the background, you can spot risky patterns without piling on friction for everyone else.

How Fingerprint supports payment authentication

Fingerprint is a device intelligence platform that helps businesses identify the devices behind online interactions with exceptional accuracy. It analyzes over 100 browser, device, and network signals to create a persistent visitor ID that can recognize returning devices, even across incognito sessions, cookie clearing, VPN use, or IP rotation. Along with this identifier, Fingerprint provides over 20 Smart Signals that surface risk indicators like bot activity, VPN or proxy use, and signs of device tampering.

In payment authentication, Fingerprint acts as a silent layer that strengthens the connection between a transaction and the person making it. By recognizing trusted devices and flagging high-risk ones, it helps issuers and merchants apply adaptive authentication. Low-risk, known devices can pass through without extra steps, while suspicious devices can trigger step-up verification, such as a 3DS challenge or one-time code. This reduces friction for legitimate customers while keeping fraud out.

Fingerprint also provides a source of evidence for compliance with requirements like Strong Customer Authentication under PSD2. Its device recognition and risk signals can support multi-factor or risk-based authentication flows, improving approval rates and reducing false declines by giving issuers and payment processors greater confidence in each transaction.

Boost your payment authentication with device intelligence

With the right mix of authentication methods, device intelligence, and a little common sense, you can strike the perfect balance between security and a seamless user experience.

Ready to strengthen your payment flows without adding friction? Start a free trial of Fingerprint to see how device intelligence can enhance your authentication strategy, or reach out to our team to design a solution tailored to your platform.

Ready to solve your biggest fraud challenges?

Install our JS agent on your website to uniquely identify the browsers that visit it.