Credit card fraud can hit your business hard, with online transactions particularly vulnerable.

E-commerce platforms, retailers, and financial institutions risk incurring huge financial losses due to fraudulent activities. You might think your business is too small to be targeted, but size doesn't matter to fraudsters: All businesses processing credit card payments are at risk.

This is where credit card fraud detection software becomes your ally against theft and suspicious transactions.

With fraud detection software, you're setting up a strong guardrail that can save you from the headaches of chargebacks, fines, and damaged customer relationships.

This article outlines the features you need to look out for when choosing credit card fraud detection software. We’ll also highlight eight of the top software tools on the market to help narrow down your options.

What features should you look for in credit card fraud detection software?

According to Time Stamped, the U.S. is awash in credit card scams: The U.S. FTC reported $8.8 billion lost because of fraud in 2022.

You can avoid the same fate by choosing the right credit card fraud detection software.

When choosing software, you need to consider features that detect anomalies in real time and offer robust fraud prevention and management tools. The right technology can significantly reduce the risk of fraudulent transactions and the hassle of dealing with chargebacks.

Real-time monitoring

Real-time monitoring helps businesses identify and react to scams swiftly. Look for software that performs anomaly detection during every transaction, leveraging AI and machine learning models to spot irregular patterns indicative of fraud.

Chargeback prevention and management

Credit card chargeback fraud is a common scam. Efficient chargeback prevention and management are key to minimizing lost revenue. Your software should not only help prevent chargebacks but also streamline the investigation and refund process to reduce false declines.

Device intelligence

Software with device fingerprinting capabilities enhances your cybersecurity measures by identifying the unique attributes of a customer's device. This aids in differentiating legitimate users from those who might be part of a fraudulent scheme.

Multi-layered authentication

According to Adroit Market Research, the global multi-factor authentication market will surpass $20.23 billion by 2025. Incorporating multiple authentication steps, including 3-D Secure, AVS, and CVV checks, can effectively prevent account takeovers. Multi-layered authentication is a critical line of defense against unauthorized access.

Bot detection

Bot detection tools like F5 Distributed Cloud Bot Defense prevent automated bot activity that can lead to massive fraud incidents. Detecting and blocking bots is a non-negotiable aspect of fraud detection software.

The 8 top credit card fraud detection software for business

Whether you're a small business or part of a larger enterprise, the following eight tools can help identify and prevent fraudulent activity.

1. Fingerprint

Fingerprint is a device intelligence platform designed to accurately identify and evaluate the intentions of every user in real time — even if they're anonymous.

It excels in credit card fraud detection and prevention by offering industry-leading accurate identification system. It also offers real-time actionable intelligence, bot and human distinction, and helps with Know Your Customer (KYC) implementation.

Fingerprint’s superiority in fraud prevention stems from its high identification accuracy, comprehensive detection of bots and malicious activities, and the ability to provide actionable insights for informed decision-making.

Key features and benefits

- Easy to set up

- Integration is seamless and smooth

- Active, quick, and helpful support team

Pricing

- Pro: $99 per month

- Enterprise: Contact Fingerprint for details.

2. Riskified

Riskified is an AI-powered fraud management and risk intelligence platform that maximizes revenue and profit for e-commerce merchants.

It provides accountable fraud management by leveraging human ingenuity and AI for high approval rates, along with precise decision-making based on extensive data attributes.

Riskified's solutions include Chargeback Guarantee, Policy Protect, Dispute Resolve, and Account Secure. These are designed to enhance the shopping experience while preventing fraud and abuse.

Key features and benefits

- Specializes in ecommerce brands

- Tech support always available

- Intuitive dashboard with easy-to-understand KPIs

Pricing

Pricing available by request.

3. SEON

SEON is a fraud prevention platform offering tools designed to combat online fraud through email, phone, IP analysis, device fingerprinting, and AI-driven insights.

It provides a comprehensive and customizable approach to fraud detection. The platform supports businesses across various industries by enhancing their ability to detect and prevent fraudulent activities in real time.

SEON emphasizes ease of integration, flexibility, and efficiency in fraud management, aiming to deliver immediate value to its users.

Key features and benefits

- Wide data range

- Interface can be customized

- Easy to integrate with existing business tools

Pricing

- Free: $0 forever (2 users)

- Starter: $599 per month (10 users)

- Premium: Contact them for details (unlimited users)

4. Kount

Kount is a comprehensive fraud detection and chargeback management solution. It integrates advanced AI, extensive global data, and flexible technology to safeguard online transactions.

It also offers a customizable approach to combat payment fraud, identity theft, and compliance risks, catering to various industries.

Kount's platform emphasizes automation, reducing manual processes, and enhancing decision accuracy. It’s a robust tool for businesses aiming to minimize fraud while optimizing customer experiences.

Key features and benefits

- Alerts that help you catch chargebacks before processing

- Quick, friendly, and responsive team

- User-friendly and intuitive tools that are easy to learn and train people on

Pricing

- Essentials: $0.07 per transaction

- Advanced: Starting at $1,000 per month

- Enterprise: Contact them for pricing

- Custom: Contact them for pricing

5. Accertify

Accertify solves digital identity and financial fraud risks to protect organizations.

They offer comprehensive solutions including account protection, fraud and abuse prevention, payment optimization, and chargeback management. Their platform is designed to address sophisticated and complex threats to safeguard an organization's reputation.

Accertify serves a broad range of industries and boasts a significant network of customers, highlighting their effectiveness in reducing fraud and optimizing payment processes.

Key features and benefits

- Claim to be “protecting 40% of the internet”

- 8/10 top global airlines use them

- Streamlined UI with all customer information in one place

Pricing

Pricing available by request.

6. ClearSale

ClearSale provides e-commerce fraud protection. They integrate with a company's data from day one and use AI to analyze transactions for fraud.

Their system delivers immediate decisions on orders and works to approve as many orders as possible while minimizing false declines. ClearSale's team of analysts further reviews suspicious activity, ensuring high approval rates and customer satisfaction.

Their solution is designed to protect revenue and enhance the customer experience by preventing chargebacks and fraud with customizable decision timeframes and comprehensive chargeback management services.

Key features and benefits

- Specialize in e-commerce

- Great balance between fraud prevention and customer satisfaction

- Easy to set up

Pricing

Pricing available by request.

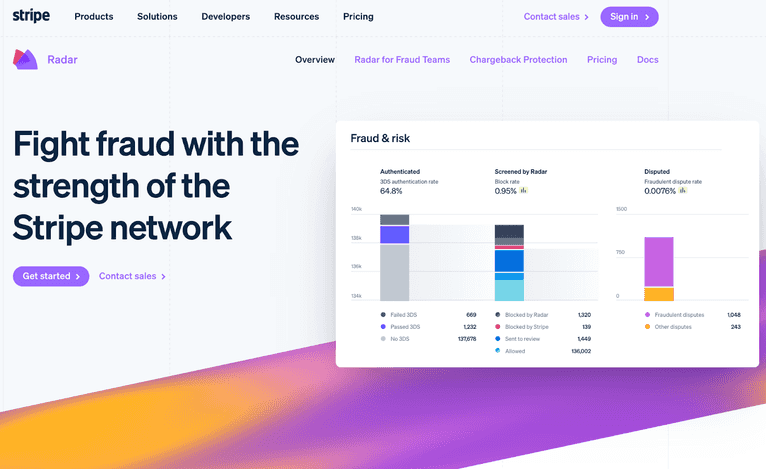

7. Stripe Radar

Stripe Radar is a fraud prevention tool that uses machine learning trained on data from millions of global companies to detect and block fraudulent transactions.

It's designed for modern internet businesses, helping to distinguish between legitimate customers and fraudsters without requiring integration, as it's built into Stripe from day one.

Stripe Radar adapts to shifting fraud patterns and unique business needs, offering protection with the strength of the Stripe network.

Key features and benefits

- Trained on billions of data points from 197 countries

- Assigns risk scores to every payment and automatically blocks high-risk payments

- Helps secure payments all over the world

Pricing

- Standard: 1.5% + €0.25 for standard European Economic Area cards. 2.5% + €0.25 for UK cards

- Custom: Contact sales for more information

8. TruValidate

TruValidate from TransUnion gives you identity, device, and behavioral insights to help your business interact securely with legitimate consumers while mitigating fraud risk. It aims to improve customer conversion, reduce fraud losses, and enhance the customer experience.

The platform does this by verifying consumer identities, assessing the risk of anonymous users, providing omnichannel authentication, and detecting potential fraud through custom analytics.

TruValidate leverages robust data to secure trust across consumer interactions, both digitally and over the phone.

Key features and benefits

- Makes it easy to share information with other people in the fraud-prevention community

- Can help improve customer conversion and reduce abandonment

- Mobile multifactor authentication feature helps you manage new and existing clients. You can connect and engage with them securely from anywhere at any time.

Pricing

Pricing available by request.

How to choose a credit card fraud detection platform

Now you know eight of the best software options for credit card fraud detection — but which one is right for your business?

Here are few key factors to consider:

- Integration: Your selection should smoothly integrate with your existing payment systems. This will help maintain operational flow and reduce the learning curve for staff.

- Global capability: Businesses handling global payments, both online and using physical cards, should ensure the platform operates internationally and adheres to global security standards.

- Security certifications: Look for platforms with recognized security certifications providing reassurance that they meet industry standards for safeguarding data.

- Customer experience vs. security: Aim for a balance between a seamless customer experience and robust fraud prevention. High accuracy in detecting fraudulent activities without causing significant inconvenience to genuine customers is key.

- Minimizing false positives: Pay attention to platforms with a low rate of false positives, as frequent blocks on valid transactions can frustrate customers and potentially drive them away.

- Risk scoring and real-time analysis: Real-time risk scoring capabilities allow for instantaneous decisions on credit card transactions, reducing the window for fraudsters to act.

- Responsiveness and support: Consider the responsiveness of customer support and the availability of resources. Fast assistance during a fraud attack is crucial.

When evaluating options, remember the most important benefit of credit card fraud protection: Preserving the reputation you have with your customers.

Elevate your protection against credit card fraud with Fingerprint

Credit card fraud can cost you money, reputation, and customers. That’s why you need a fraud solution that can stop fraudsters in their tracks.

Fingerprint is a device intelligence platform that identifies all visitors with industry-leading accuracy. It uses device fingerprinting, behavioral analysis, and machine learning to detect and block fraudulent transactions.

With Fingerprint, you can improve your security, compliance, and customer experience. You can also reduce chargebacks, false positives, and manual reviews. For further reading, check out our article on credit card cracking.

Elevate your protection against credit card fraud. Contact Fingerprint today and talk to our sales team.

FAQ

- Fingerprint

- Riskified

- SEON

- Kount

- Accertify

- ClearSale

- Stripe Radar

- TruValidate