Summarize this article with

YOLO doesn’t always mean “you only live once.”

Sometimes it means “you only lose once.”

For digital finance and trading platforms competing in a rapidly changing and highly competitive marketplace, you can only lose customer funds once before you lose their trust (and their business) forever.

To keep that user trust intact, fraud and risk teams face a number of critical challenges and requirements. They need to ensure they have tight controls on both identity verification and account security in place at all times, and their platforms and fund protections must be in full compliance under regulatory scrutiny.

Any lapse in their defenses or loss of user funds can lead to expensive lawsuits and exorbitant fines, cause real strain on their teams and systems, and damage their brand reputation and business as a whole.

In this article, we’ll break down the challenges trading platforms face in stopping fraud and delivering secure user experiences. We’ll also look at some of the fraud detection and prevention tools they are using today, and how they can augment these tools to solidify their defense systems.

The challenges of fraud prevention at trading platforms

Fraud and risk teams today have to strike the right balance between growth and security. Just as they must maintain tight anti-fraud measures to stay ahead of threats like account takeovers and brute force attacks, they cannot restrict any potential opportunities for new revenue streams.

As they build new offerings and grow across new geographies, the risks multiply as fast as users can sign up. This is doubly true as trading platforms look to expand into new areas like crypto, tokenized assets, dApps, and prediction markets, which all have unique threats and novel attack vectors.

With a mandate to support growth as the backdrop, technical teams must find ways to streamline any onboarding and login friction for new users. It’s imperative that they can reliably distinguish between who’s a legitimate customer and who’s a fraudster.

Fraud teams also have to stay current with the highest standards of regulatory compliance. Anti-fraud controls need to be appropriate and effective across new product offerings, as well as across numerous geographies and jurisdictions. If there are gaps in Anti-Money Laundering (AML) and Know-Your-Customer (KYC) procedures, regulatory fines and legal settlements can run into the millions, and erode user trust.

Yet simply implementing the most stringent authentication requirements can throttle new account growth and put a drag on the user experience. This can be a real concern in the cutthroat and fast-moving world of cryptocurrency and tokenized asset trading, where user trust, ease-of-use, and speed-of-use are high priorities.

While trading platforms are currently using a number of fraud prevention tools and techniques, those methods can have drawbacks and limitations.

Popular trading platform fraud prevention techniques and their limitations

Every trading firm employs a variety of tools and techniques in its fraud defense efforts. Each of these methods can have its advantages and its limitations.

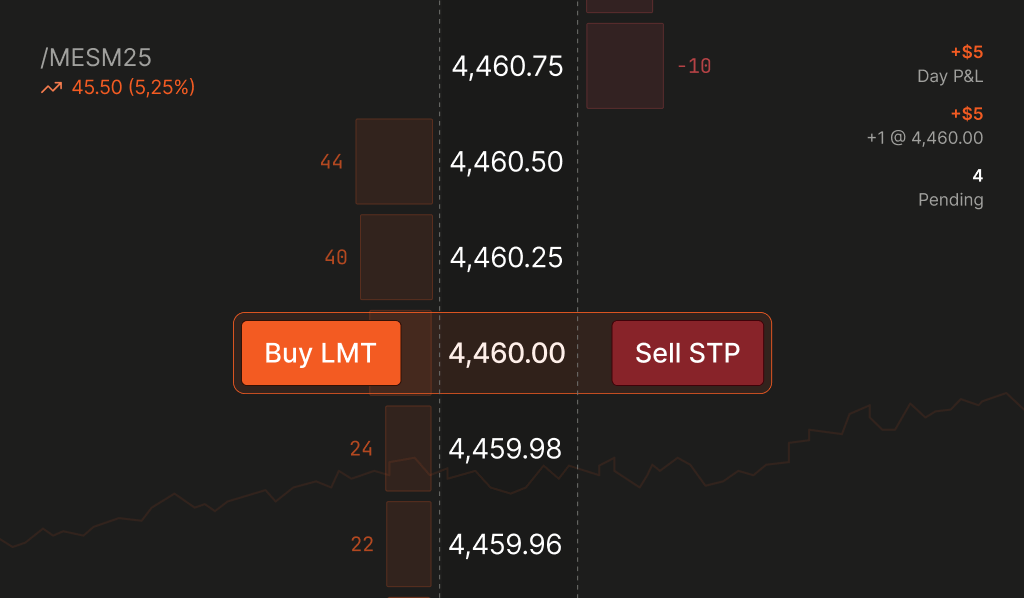

One key focus area is detecting and preventing trading anomalies. From sudden spikes or drops in activity to abnormally high transaction rates in short periods of time, any outliers can be a sign of market manipulation or system abuse. Fraud and risk teams will use a combination of data processing, statistical analysis, and risk scoring to determine if any activity seems suspicious — and they will have processes to respond when strange patterns are detected or risk thresholds are crossed.

Another area of focus for trading platforms is strong access controls. Each firm has its own unique approach to user verification and account security — from MFA to KYC requirements to password expiration policies. Yet whether it’s through social engineering, credential stuffing, or account creation fraud, scammers will test these login flows and user authentication systems. Fraud teams must be vigilant to stay ahead of the bad actors.

Graph modeling is another tool that fraud teams may employ to try to flag risky activity. Sometimes called fraud graphs, this is a visual representation of the connections between users and their attributes, assets, and accounts. These graphs can be a useful tool for grouping, sorting, and flagging risky users and potentially malicious behavioral patterns.

However, while all these tools and techniques are important as part of a holistic fraud defense system, they can have weaknesses and limitations. One of the main limitations is due to how the device and behavior data are processed. In other words, these tools are only as strong as the data they use as inputs — aka, the age-old garbage in, garbage out problem.

In order to be truly effective at linking connections and flagging risky activity, graph and anomaly detection models need to have the most current and accurate data possible. For example, if risk and fraud teams can integrate more precise, persistent, and real-time signals for IP geolocation, VPN usage, and login velocity, they can build a more complete and effective fraud graph — which can make it easier and faster to identify repeat offenders or coordinated fraud attempts.

With real-time, reliable signals and device intelligence, trading platforms can enhance their data fidelity for more effective fraud detection and prevention.

Device intelligence: Getting the most accurate data to fuel your fraud strategies

The Fingerprint team works closely with leading financial firms and trading platforms, and we know the challenges of stopping fraud firsthand.

Device intelligence is a key component for strengthening data fidelity and account security — without any noticeable impact to the user experience or onboarding flows. With highly accurate device data, fraud teams get deeper insights into every visitor in real time, even if they’re anonymous or using a VPN. And trusted users get a smoother and more personalized experience.

Fingerprint delivers actionable insights with industry-leading accuracy, even when fraudsters try to hide. Our visitor ID reliably identifies users even if they clear cookies or use VPNs and proxies. Additionally, we provide actionable Smart Signals to determine risk from bot and emulator detection, to browser tampering detection, and more.

When device intelligence and Smart Signals are both incorporated into existing fraud defense systems, teams get access to more current and accurate device data. This can help with advanced and emergent threat vectors, including autonomous attacks. For example, it can detect AI agents, flag when multiple accounts are coming from the same virtual machine or suspiciously uniform device setups, timing anomalies, and other fraud patterns.

What’s more is that any fraud graphs and data models being used by fraud teams become richer and far more accurate, which can give those teams even more of an edge in their fraud prevention efforts.

Real-time, accurate signals are a requirement, not a nice-to-have

In a world where fraudsters are constantly finding new ways to test defenses, fraud teams need to have the best fraud prevention tools possible — because the potential loss of customers and impact on revenue and reputation can be immense.

Device intelligence can be a key asset for teams who want to build and implement strong and compliant account security measures. It can enhance the effectiveness of current tools like anomaly detection and graph intelligence. And by adding more precise and persistent signals to data models, it can empower faster fraud detection and prevention practices.

Want to see how Fingerprint can augment your fraud defenses? Our team is available to chat about your team’s needs. Or you can start now and try device intelligence yourself with a free trial.