Summarize this article with

Have you ever answered a call from an unknown number, only to hear a recorded message claiming you've won a lottery or are eligible for an exclusive financial offer? Often disregarded as mere nuisances but familiar to many, these calls represent a basic form of wire transfer fraud.

The tactic is simple: lure unsuspecting individuals with an attractive offer and then deceive them into transferring money or providing sensitive information under pretenses to access their winnings. If you understand how these bots operate and the threats they pose, you can better recognize and mitigate their impact.

In this article, we're diving into bot-driven wire transfer fraud. This advanced form of fraud uses automated software to enhance the scale and efficacy of these deceptive practices. You'll learn about the mechanisms of bot-driven wire transfer fraud, its impact on individuals and businesses, and, most importantly, strategies to prevent it.

What is Bot-Driven Wire Transfer Fraud?

Wire fraud is a prevalent issue in today's financial environment that uses some form of telecommunication or the internet, such as emails, texts, or phone calls.

Termed the "wire," these tools become instruments of deceit in the hands of fraudsters. Specifically, wire transfer fraud focuses on illegally accessing bank accounts and siphoning funds or assets. Recognized as a severe crime, it often leads to significant legal consequences and losses for the victims.

The impact of fraud intensifies with the use of automated software or bots, which can perform fraudulent actions faster than humans. While generally thought of as a bot sending countless emails about a fictional foreign dignitary needing wire transfer assistance, the reality is more complex. Bots can play many roles in wire transfer fraud, enhancing the efficiency and scale of fraudulent activities.

The following sections will examine the various aspects of wire transfer fraud escalated with bots. From automating phishing campaigns to manipulating transaction processes, these bots represent a formidable tool in the arsenal of fraudsters. Understanding their functionality and the threats they pose is the first step to developing effective countermeasures.

Automated Phishing

When most people think of wire transfer fraud, they often jump to phishing. Phishing is a deceptive practice where fraudsters masquerade as legitimate entities to trick individuals into revealing sensitive information, such as login credentials, or, in this case, directly transferring funds. This widely recognized and discussed fraud leverages individuals' trust in communications from seemingly reputable sources.

Automated phishing operates through a mass distribution of these deceptive communications. Bots are programmed to send many emails, make countless calls, or send tons of text messages. These communications often mimic legitimate sources, like banks or government agencies, to seem credible. By automating the process, fraudsters can target a vast audience with minimal effort, increasing their chances of success.

Examples of Automated Phishing Schemes

Fraudsters use diverse media formats for phishing. Emails include official-looking logos and layouts, while calls could employ AI or voice manipulation to mimic real people. Text messages may contain links to fraudulent websites that appear genuine. Some typical schemes include:

- Emails from a "bank" asking to verify account details.

- Calls about fake tax dues from entities posing as the IRS.

- Text messages with links to claim non-existent prizes or refunds.

- Fake job offers requiring payment for training or equipment.

- Calls from "tech support" claiming to fix non-existent computer issues.

Automated Phishing Wire Transfer Overview

The process typically follows these steps:

- Target Identification: Using bots to identify potential victims through data scraping or purchased lists to build a profile.

- Message Distribution: Sending out phishing emails, texts, or calls in large numbers using networks of bots.

- Response Handling: Once a target responds, the bot or a human guides them through the fraudulent process.

- Fund Transfer: Convincing the victim to transfer funds through common channels like Zelle, Western Union, or bank transfers.

How to Prevent Phishing Wire Transfer Fraud

- Educate and Train: Regularly update yourself, your employees, and your customers about the latest phishing tactics and how to recognize them.

- Verify Sources: Always double-check the legitimacy of requests for sensitive information or money transfers, especially if they claim to be urgent. Contact the entity through official channels directly.

- Implement Security Tools: Use email filters, caller ID apps, and web protection tools to reduce exposure to fraudulent communications.

Account Takeover

Account takeover (ATO) represents a significant threat in the domain of wire transfer fraud. Unlike phishing, which relies on deception to gather information, ATO directly targets account credentials to gain unauthorized access to user accounts. Fraudsters employ various methods to achieve this, each with its unique approach and level of sophistication.

Common Account Takeover Tactics

Credential Stuffing

Credential stuffing stands out as a prevalent technique in ATO. This method leverages automated bots to test combinations of usernames and passwords that have been leaked or stolen across multiple websites. This technique is often effective since many users recycle the same password for different accounts. When these bots successfully log in, they grant fraudsters access to the accounts, paving the way for unauthorized transactions and illicit funds transfers.

Exploiting Website Vulnerabilities

While credential stuffing is a significant threat, ATO can also include other tactics, such as targeting vulnerabilities within website security. By exploiting these weaknesses, fraudsters, often employing automated bots, can harvest user data. These bots are programmed to scan for and exploit known security vulnerabilities, allowing attackers to access many accounts without login credentials.

Malware Installations

Additionally, malware installed by unsuspecting users can be used to record keystrokes or extract stored login information. This malware often operates in conjunction with bots that automate the process of gathering and transmitting this sensitive data back to the fraudsters.

Once fraudsters have accessed the account, they often automate transactions to transfer funds quickly. Bots are programmed to execute wire transfers, often dispersing funds to various accounts to complicate traceability. The speed and efficiency of these automated transactions make them particularly dangerous, as they can drain accounts before the victim or financial institutions can react.

How to Prevent ATO Wire Transfer Fraud

- Use Multi-Factor Authentication (MFA): MFA significantly reduces the risk of unauthorized account access, even when credentials are compromised, by requiring additional proof to access your account.

- Monitor Activity: Organizations should use tools that detect and alert about suspicious login attempts or unusual transaction patterns within their networks. Additionally, consumers should regularly monitor unusual activities in their financial accounts.

- Educate Users About Secure Practices: Financial companies should inform users about the importance of unique passwords and the risks of reusing credentials across multiple platforms. They should communicate the official methods for getting in touch with legitimate representatives.

- Deny Bot Visitors: Use tools to distinguish real human users from automated computers accessing sites. This way, services can develop processes to handle bots appropriately and prevent unauthorized access to accounts and assets.

Transaction Interception

Transaction interception represents a sophisticated and stealthy method fraudsters employ to redirect legitimate wire transfers. While automated phishing and account takeover techniques are more widely recognized, transaction interception operations infiltrate communication channels or networks to discreetly alter the course of financial transactions.

Common Transaction Interception Methods

Manipulating transaction flows is usually seen in email-based interception and network infiltration and monitoring. With email-based interception, specifically Business Email Compromise (BEC), fraudsters use bots to target email systems, usually through phishing schemes. Once unauthorized access is secured, they patiently monitor email exchanges, awaiting wire transfer instructions.

When a wire transfer is initiated, they spring into action, subtly altering critical transaction details. This manipulation usually includes changing the recipient's bank account number, thereby rerouting the funds to the fraudster’s account.

On a more advanced level, fraudsters can use bots to infiltrate entire financial networks to scan and affect transactional data in real time. Armed with a deep understanding of network protocols and often exploiting security vulnerabilities, they intercept and manipulate transaction details during the transmission process or generate their own. This technique is much more difficult to achieve and seen less often, but it still threatens financial systems.

Preventing Transaction Interception Fraud

- Enhanced Email Security: Strengthen email security with advanced phishing detection tools, spam filters, and multi-factor authentication (MFA).

- Employee Education: Continuously educate staff on recognizing phishing attempts and handling financial information securely.

- Network Security Upgrades: Bolster network defenses with firewalls, intrusion detection systems (IDS), and intrusion prevention systems (IPS).

- Transaction Verification Protocols: Establish robust protocols for verifying wire transfer instructions, especially for high-value transactions.

- Monitoring and Analytics: Implement continuous monitoring of network traffic for unusual activity and employ data analytics to detect patterns indicative of interception attempts.

- Incident Response Plan: Maintain an incident response plan outlining actions you must take if you suspect transaction interception, including promptly communicating with your financial institution.

How to Detect Bots with Fingerprint

The first step in preventing bots from aiding in wire transfer fraud is identifying them. Fingerprint's Device Intelligence Platform combines multiple signals, advanced matching algorithms, and server-side techniques to provide a comprehensive view of your site visitors with industry-leading accuracy.

Specifically, the Smart Signals suite includes Fingerprint Bot Detection, which collects extensive browser data that bots inadvertently leak while interacting with websites. This data includes errors, network overrides, browser attribute inconsistencies, API changes, and more. By analyzing this data on the server side, Fingerprint Bot Detection reliably distinguishes real users from headless browsers, automation tools, and bot derivatives.

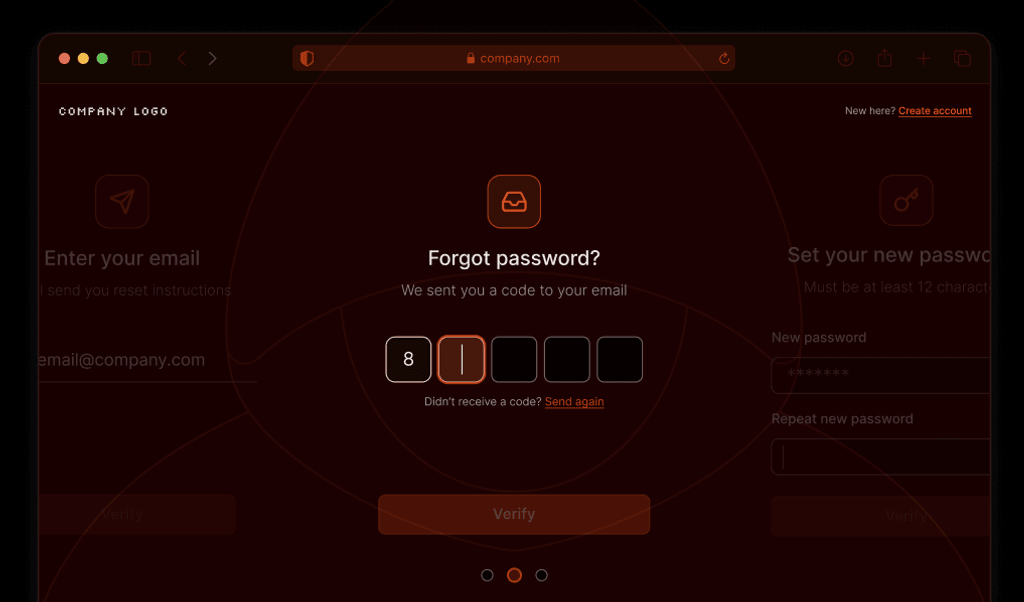

To determine if a visitor is a bot, first create an identification request using the Fingerprint JavaScript agent.

// Initialize the agent.

const fpPromise = import("https://fpjscdn.net/v3/<your-public-api-key>").then(

(FingerprintJS) =>

FingerprintJS.load({

endpoint: "https://metrics.yourdomain.com",

})

);

// Make an identification request

const { requestId } = await (await fpPromise).get();Once you have the request ID, use the Server API to learn more about the visitor. In the response from the server, specifically in the products.botd.data object, you will find information discerning if the visitor is a bot or a human.

{

"products": {

...

"botd": {

"data": {

"bot": {

"result": "notDetected"

},

"url": "https://www.example.com/login",

"ip": "61.127.217.15",

"time": "2024-01-17T16:40:13Z"

}

}

...

}

}The result object can return one of the following values: notDetected, good, or bad.

notDetectedmeans that we haven't detected a bot, and the visitor is a human.goodshows that the bot is a well-known web crawler or search engine bot.badindicates an automated tool that doesn't have legitimate uses and assumes fraudulent activity.

Using this information, you can treat the visitor appropriately, either continuing with the action, asking for more information or proof that they are human, or blocking the action entirely.

Conclusion

The rise of bot-driven wire transfer fraud presents a significant challenge, requiring individuals and organizations to adopt proactive security strategies. These strategies involve staying updated on fraud tactics, implementing robust measures like multi-factor authentication, regular account and activity monitoring, and educating all humans on best practices. By maintaining awareness and preparedness, we can effectively protect against these evolving threats and protect financial assets and personal information.

To discover how Fingerprint can help you in your fight against bots, contact our sales team or start a free trial to begin your fraud prevention journey.