Summarize this article with

The landscape of online fraud prevention is undergoing a fundamental transformation. According to Gartner's recent report, "Emerging Tech: The Future of Online Fraud Prevention," the fraud prevention and cybersecurity are coming together under one team. This trend, which Gartner calls "cyberfraud fusion," creates an opportunity for companies to streamline their fraud prevention efforts and for vendors to shift toward consolidated platforms.

What is cyberfraud fusion?

Historically, fraud prevention and cybersecurity have operated as distinct divisions within organizations. Fraud teams have focused on user behavior, such as transactions and usage patterns, while cybersecurity teams have concentrated on infrastructure security, including network defense and access control.

However, as digital threats have evolved, these boundaries are dissolving. Gartner explains, "Cyberfraud fusion describes an emerging trend within the security market where elements of cybersecurity, identity, and online fraud prevention are combined into holistic defenses to combat fraud online."

Who is impacted by cyberfraud fusion?

Gartner predicts that "Cyberfraud fusion is expected to accelerate and become increasingly important through 2031 as organizations of all sizes continue to reach the understanding that online fraud is a cybersecurity issue."

This change is hitting some sectors before others. "At present, cyberfraud fusion appears to be most relevant to online banking and financial services, but large retail organizations are also following suit," the report states. Gartner projects, "By 2031, at least 50% of large financial institutions and online retailers will consolidate online fraud prevention personnel, duties and responsibilities into cybersecurity teams reporting to the CISO."

Why is cyberfraud fusion happening?

Several forces are pushing for tighter sharing and broader use of data.

Evolving approaches to threats

Many tools now leverage machine learning and other sophisticated techniques to assess risk based on observed behavior. These assessments need data from throughout the customer lifecycle. As Gartner puts it, “The need to identify the overall patterns and trends in financial crime, rather than isolated transactions, is driving consolidation of solutions as vendors strive to position themselves as a one-stop shop for financial crime solutions.”

Governments are also beginning to require that companies share information with them to track and learn about fraud and security issues. “Regulatory compliance in some regions around the globe has already begun necessitating data collection and sharing between security and online fraud prevention products,” the report explains. “For example, the EU’s Digital Operational Resilience Act (DORA) is now triggering a standard approach to reporting incidents across the 27 countries in the EU.”

The problem of too many tools

One of the primary drivers of consolidation is the overwhelming complexity of managing many narrowly focused pieces of software. Organizations today often juggle numerous tools across different teams, creating inefficiencies and gaps in coverage.

"Buyers are expressing increasing frustration over gaps in coverage due to lack of depth and breadth from point solutions," writes Gartner. "Component technologies are still deployed and managed individually, resulting in data silos that necessitate information sharing and ingesting between systems. These disconnects and gaps between systems, teams, and processes hinder cohesive defense strategies.”

The cyberfraud fusion tech stack

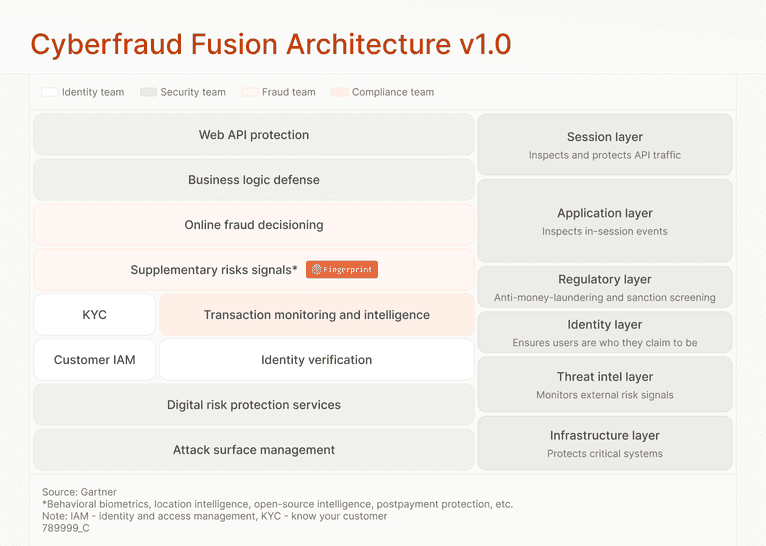

As more functions work under a single banner, these teams will demand a unified platform for fraud and cybersecurity. Gartner predicts that “by 2029, more than 50% of vendors will offer fully consolidated online fraud prevention technology stacks combining elements of digital risk protection services, business logic protection, identity verification, and decision engines."

Figure 1: Gartner’s cyberfraud fusion architecture incorporates six layers of software services traditionally dispersed across different teams. Fingerprint fits into the “Supplementary risks signals” layer.

Because a growing proportion of software purchases will be made within these unified teams, "online fraud prevention vendors must begin making inroads with security teams in the near term to understand their buying considerations and requirements. These will be different from what fraud teams typically require and more complex."

The role of risk signals like device intelligence

As seen in Figure 1 from the report, supplementary risk signals are a key part of the cyberfraud fusion stack, whether incorporated as part of a unified platform or a best-in-breed approach. As one of these signals, device intelligence uses a set of characteristics unique to each device to establish a persistent identifier. An instant, passive, high-accuracy trust signal is useful to both security and fraud practices, so it can offer value across an organization that’s embraced cyberfraud fusion.

Because “tightly integrated solutions create a holistic defense, eliminating gaps and data silos while also increasing the overall efficacy of the solution,” it’s essential that vendors and buyers look for device intelligence solutions that integrate quickly and easily with their architecture.

Preparing for the future

Gartner warns that "product leaders who refuse to invest in hybrid offerings that appeal to security teams will find their success fading over the next five years."

The future of online fraud prevention lies in breaking down organizational and technological silos, and creating unified defenses against the full spectrum of digital threats. Organizations that embrace this cyberfraud fusion approach will be better positioned to protect their users, data, and reputation in an increasingly complex threat landscape, and the vendors who support this new approach are the best positioned to thrive.

Gartner, "Emerging Tech: The Future of Online Fraud Prevention," Dan Ayoub, Pete Redshaw, Sean O'Neill, Vatsal Sharma, 30 January 2025

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally. All rights reserved.