Summarize this article with

In 2023, consumers reported more than $10 billion in fraud losses overall, according to the FTC, with the real loss probably several times higher. Many of these schemes exploit accounts after identity checks, making post-KYC fraud a growing challenge for fintech, e-commerce, and marketplace companies. As a result, device intelligence has moved from “nice to have” to “must have.”

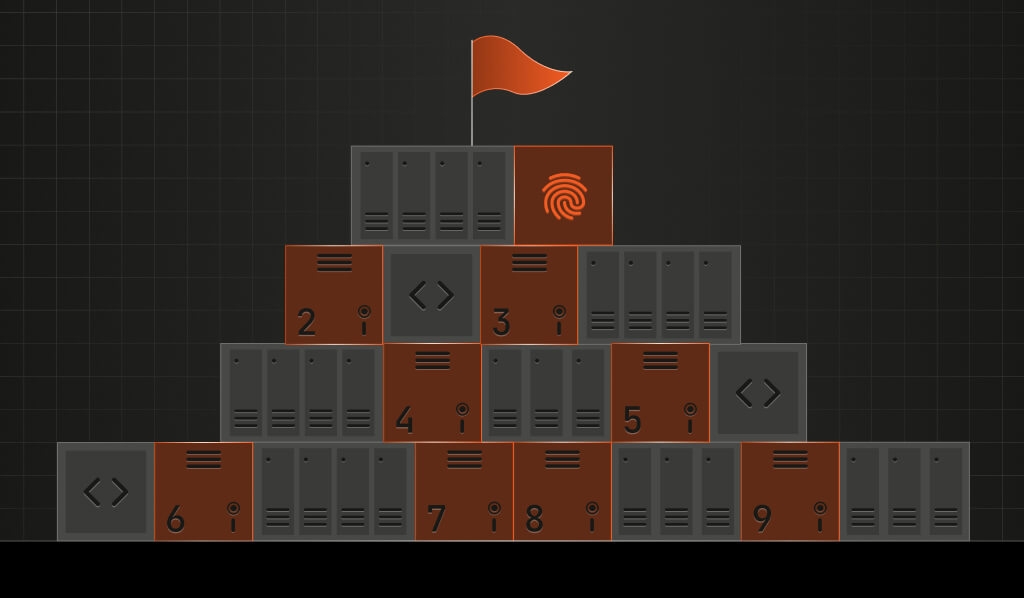

Here’s a look at how the twelve best device intelligence platforms stack up — and what you need to know to prevent fraud throughout an account’s lifecycle.

Why static fraud checks are failing

One-time onboarding checks — like Know Your Customer (KYC) verification and ID document scans — aren’t effective in preventing future fraud attempts. In fact, fraudsters make a point of breaking into verified accounts, either through phishing or buying data on the dark web. Once they’re in, they use emulators, app cloners, and bots to hijack accounts, drain funds, and milk promotions.

Device intelligence picks up where static controls like KYC checks leave off: monitoring every session and transaction in real time, and flagging suspicious behavior as soon as it pops up.

Device intelligence vs. device fingerprinting: What actually matters

Device fingerprinting creates a unique device ID by hashing browser or operating system details, such as user-agent strings, installed fonts, and hardware settings. That’s how companies using this technology know whether they’ve seen a certain device before and associate it with one or several accounts.

Device intelligence goes further. On top of the device ID, it layers in behavioral and network signals that highlight network anomalies, emulator usage, automation frameworks, and other potentially risky signals to fraud and risk teams. By layering device intelligence on top of device fingerprinting, businesses get deeper risk analysis, fewer false positives, and the ability to spot sophisticated attack vectors in real time. Some services even can distinguish between good bots and AI agents (like search engine crawlers) and bad ones.

The real problem: Post-KYC fraud & the ROI of device intelligence

About 76% of fraud now happens after identity verification has been completed. Fraudsters focus on methods designed to bypass weak device identification capabilities, such as SIM swapping, VPN and proxy use, and IP changes. Device intelligence changes the game by spotting these anomalies in real time. Persistent device identification can translate to fewer chargebacks, less promo abuse, and measurable bottom-line gains.

The signals that actually stop modern attacks

Strong device intelligence platforms don’t just look for obvious red flags. They combine hundreds of technical signals to expose fraud patterns, without collecting personally identifiable information (PII). Here are some of the essential signals a good solution should provide:

- Browser entropy values: Helps detect spoofed environments or cloned browsers trying to blend in.

- Time-zone/IP mismatch: Flags when a device’s system time doesn’t match its IP location, a classic sign of fraudsters trying to cloak their true location through virtual private networks (VPNs) or proxies.

- Emulator or virtual machine artifacts: Spots devices running in virtual environments, as opposed to normal phones or computers.

- Sensor spoofing (GPS, gyro): Uncovers fake or manipulated sensor data, often used to fake location or device movement.

- Automation frameworks (Selenium, Puppeteer): Reveals scripted bot flows attempting to automate fraud at scale.

All of these signals rely on technical device metrics only, which have nothing to do with the user’s identity, so privacy is preserved while fraudsters are exposed.

Note: Some device intelligence providers do link personal info with unique devices, a technique that leads to higher confidence in identification accuracy but also introduces regulatory issues around privacy.

Other considerations when evaluating device intelligence platforms

Accuracy & false-positive rates

Top performers deliver high accuracy with low false-positive rates. That means fewer real users get blocked or challenged, which translates to smoother onboarding and less lost revenue. Platforms with higher false positives risk turning away legitimate customers, which hurts conversion and trust. That said, true accuracy is notoriously difficult to calculate, so be skeptical of precise claims.

Integration time & developer effort

Integration times vary by platform and implementation scope. Lightweight SDKs can enable quick initial rollouts, while production deployments may offer deeper integration at the cost of bulkier implementation and maintenance. The best solutions use both client- and server-side techniques for better and more secure risk analysis.

Privacy compliance & data handling

All vendors listed claim GDPR and CCPA compliance, though it’s up to the customer to use device intelligence in a compliant way. Some platforms, like Fingerprint and JuicyScore, offer in-region data storage. If a vendor relies on third-party data enrichment or links to PII, double-check compliance, especially in sensitive markets.

The top device intelligence platforms for fraud prevention

Fingerprint

Fingerprint is a device intelligence platform offering highly accurate browser and device identification. It uses 100+ signals to assign each visitor a unique, persistent visitor ID. The platform also provides 20+ Smart Signals, including Bot Detection, VPN Detection, Incognito Detection, Emulator and Virtual Machine Detection, Developer Tools Detection, Geolocation Spoofing Detection, and more.

Fingerprint’s lightweight SDK can be integrated quickly, delivers low-latency results, and supports server-side analysis and identification retrieval for enhanced security.

- Strengths: Fast deployment, highly persistent visitor ID, broad signals coverage, flexible integration, industry-leading accuracy

- Industries: Fintech, financial services, gaming and gambling, e-commerce, SaaS, marketplaces

- Pricing: Identification API calls per month

If you want to see how Fingerprint performs in your environment, get started with a free trial.

Sumsub

Sumsub is an integrated fraud stack, combining KYC/KYB onboarding ID verification with ongoing monitoring that includes device intelligence powered by the Fingerprint platform.

- Strengths: Verification throughout the account lifecycle, device behavioral analysis

- Industries: Fintech, payment, trading, crypto, igaming, mobility, marketplaces, neobanks

- Pricing: Starts at $1.35 per verification, custom enterprise pricing available

SEON

SEON is a compliance platform that incorporates AML screening, case management, and regulatory reporting. It generates device fingerprints as one of several signals to be considered by its decisioning.

- Strengths: Aggregated digital risk signals, transparent decisioning

- Industries: Fintech, financial services, payments, iGaming, retail

- Pricing: Tiered, usage-based

SHIELD

SHIELD uses device IDs and behavioral analytics to detect fraudulent behavior, primarily on mobile devices. Their clientele is mostly in Asia.

- Strengths: Behavioral modeling, focus on mobile devices

- Industries: Ride hailing, superapps, online delivery, social media, streaming, e-wallets, digital and neobanking, online casinos

- Pricing: Custom enterprise pricing, based on unique users or API calls

DataVisor

DataVisor uses unsupervised anomaly detection to identify fraud in financial institutions users’ accounts and transactions.

- Strengths: ML clustering, flexible orchestration, responsive support

- Industries: Banks, credit unions, fintech, digital payments

- Pricing: Custom, oriented toward larger enterprises

Experian FraudNet

FraudNet is a risk engine that uses device intelligence as an input.

- Strengths: Third-party data enrichment, KYC integration, edit rules within UI

- Industries: Advertising & media, automotive, energy & utilities, financial services, healthcare, insurance, mortgage, public sector, rental property solutions, telecommunications

- Pricing: Custom

JuicyScore

JuicyScore focuses on privacy-centric, adaptive scoring, focused on markets with lighter regulatory regimes.

- Strengths: Emerging market coverage, privacy-first design, device-based account risk profiling

- Industries: Financial institutions, e-commerce, insurance, travel

- Pricing: Custom

Kount

Kount is a trust and safety solution that uses device intelligence as an input for its fraud prevention service.

- Strengths: AI scoring, chargeback defense, direct link to Equifax’s credit and identity data

- Industries: Retail, marketplaces, digital goods, financial services

- Pricing: Starts at $0.07 per transaction, custom pricing available

IBM Trusteer

IBM Trusteer protects banks from many forms of attacks with a cross-institution reputation network and multiple endpoint deployment options.

- Strengths: Behavioral biometrics, malware checks, emphasis on persistence

- Industries: Financial institutions

- Pricing: Custom

Sardine

Primarily serving fintechs, Sardine is a full-stack fraud and compliance platform with device intelligence as one input.

- Strengths: Responsive support, tight focus on banking/payments, AI-based risk process automation

- Industries: Crypto, fintech, neobanks, retail

- Pricing: Custom, complex, based on API calls and other usage, plus recurring monthly fees

Arkose Labs

Oriented toward defending large companies, especially digital platforms, from scaled fraud and automated abuse, with a proprietary CAPTCHA-like challenge

- Strengths: Bot detection, anti-scraping protections for platform content, Security Operations Center for 24/7 coordination

- Industries: Gaming, fintech, marketplaces

- Pricing: Custom, three tiers based on support level

Incognia

Focused on user identity challenges specific to gig economy and peer-to-peer apps.

- Strengths: Persistent device ID, assured identity tied to individual user

- Industries: Food delivery, P2P marketplaces, ride sharing

- Pricing: Custom, three tiers based priced by MAU or API calls

Disclaimer: This article is based on publicly available information from official company websites and reputable third-party sources as of the time of writing. Product features, pricing models, and capabilities may change over time. Readers should verify details directly with each vendor before making business decisions.

Choosing the right device intelligence solution

Match features to your industry

- Fintech: Look for account takeover prevention, proxy/VPN identification, and bot detection

- E-commerce: Prioritize distinguishing good and bad bots, long-lasting device IDs, and velocity detection

- iGaming: Must-haves are multi-accounting detection, deep geolocation identification, and emulator detection

- B2B SaaS: Focus on account sharing prevention and device trust indicators

Ready to strengthen your fraud defenses?

Weigh the strengths and trade-offs for your business, then plan a proof-of-concept to see which device intelligence solution best fits your risk profile and user experience goals.

Curious how Fingerprint stacks up in your environment? You can reach out to our team or start a free trial to experience highly accurate device intelligence and a frictionless user experience.

Ready to solve your biggest fraud challenges?

Install our JS agent on your website to uniquely identify the browsers that visit it.

FAQ

It can be, but it depends on how it is used and it’s up to the site owner to implement in a compliant way, which may require user notifications and user consent. If GDPR compliance is important to you, look for GDPR-compliant device intelligence vendors such as Fingerprint.

Yes. Leading platforms like Fingerprint spot emulators and virtual machines by checking for hardware inconsistencies, missing sensors, and abnormal drivers.

Most businesses see measurable fraud-loss reduction within 30 to 60 days after deployment.

No. SDKs designed for Android Privacy Sandbox and iOS App Tracking Transparency collect non-PII device metrics and do not require user-level ad identifiers.

It should complement them. Combining device intelligence with behavioral analytics and transaction risk models delivers higher accuracy. This efficiency translates into fewer manual reviews and ultimately lower operational costs compared to a single approach.