Summarize this article with

Imagine waking up to the nightmare of a drained bank account or hijacked social media account. With the increase in ATO (or account takeover attacks), this nightmare is becoming a reality for many, especially in the fintech and e-commerce industries. Fraudsters are getting craftier at stealing credentials, breaking into user accounts, and wreaking havoc — from emptying wallets to tarnishing reputations.

Businesses can't afford to ignore this threat, and they need to use strong tactics to protect themselves and their customers. In this article, we'll dig into account takeovers, examine real-world examples, and reveal strategies to fight back.

What is account takeover fraud?

Account takeover fraud happens when unauthorized users get access to an account, usually through stolen credentials or security vulnerabilities. These intruders usually use tactics like phishing, malware, or credential stuffing to obtain usernames and passwords, then log into systems without the account owner even realizing it. Once inside, they have full access to make fraudulent transactions, steal sensitive data, or manipulate accounts for further mischief.

The most straightforward effect of this type of fraud can be financial loss, but it also decreases customers' trust and can impact a business's reputation. One might be much less likely to work with a company they know has been the victim of an account takeover attack. The consequences can be severe for both the companies and individuals involved, and according to a 2024 report by Security.org, 29% of internet users have experienced an account takeover, up from 22% in 2021.

Industries at risk of ATOs

Any industry using online transactions and digital identities can be hit by account takeover fraud, but some industries make particularly tempting targets. High transaction volumes and sensitive operations make them especially vulnerable with high impact. Let's explore the areas that are at greatest risk for these attacks and look at why fraudsters find them so appealing.

E-commerce

Online shopping platforms are a goldmine for fraudsters. Why? Customers often save their payment information to make quick purchases. Once attackers crack an account, they can go on spending sprees or drain funds using the saved information. The sheer volume of global transactions can easily mask these nefarious activities, giving fraudsters more time to exploit accounts before anyone notices.

Financial services and fintech

Banks and fintech firms are obvious targets — they're where the money is. But fraudsters don't just want quick cash; they also go after data for identity theft and money laundering, too. As fintech companies race to innovate, they sometimes leaves security gaps that fraudsters are all too eager to exploit.

Online gaming and gambling

Gaming and gambling sites can also be juicy targets. Players often have large balances of valuable virtual goods ripe for the taking. The social nature of these platforms is a bonus for fraudsters since it's easier to spread malware or phishing scams when players trust each other. This dynamic also makes it challenging for platforms to detect and respond to fraudulent activities quickly.

Cryptocurrency

Blockchain transactions are anonymous and irreversible — once funds are gone, they're gone for good. The high value and liquidity of cryptocurrencies, combined with often lax security, make these platforms irresistible to fraudsters. Additionally, the rapid pace of new technology, platforms, tokens, etc., can lead to vulnerabilities that are not immediately obvious, further exposing users to risk.

Healthcare

Healthcare systems contain a treasure trove of detailed and sensitive data. From prescription fraud to false insurance claims, the potential for misuse is huge. Any breach here is doubly dangerous because it's not just about the money, but also patient privacy and safety. Tampering with medical records can even have life-threatening consequences. The interconnected nature of healthcare providers also increases the risk of widespread data breaches, making the entire network more vulnerable to attacks.

Account takeover methods to know

To fight account takeovers, you need to know the technical tricks and mind games fraudsters use to break into accounts. From clever software exploits to sneaky social engineering, these methods target weak spots in both technology and humans. Here are some of the most common tactics fraudsters use to gain unauthorized access to accounts.

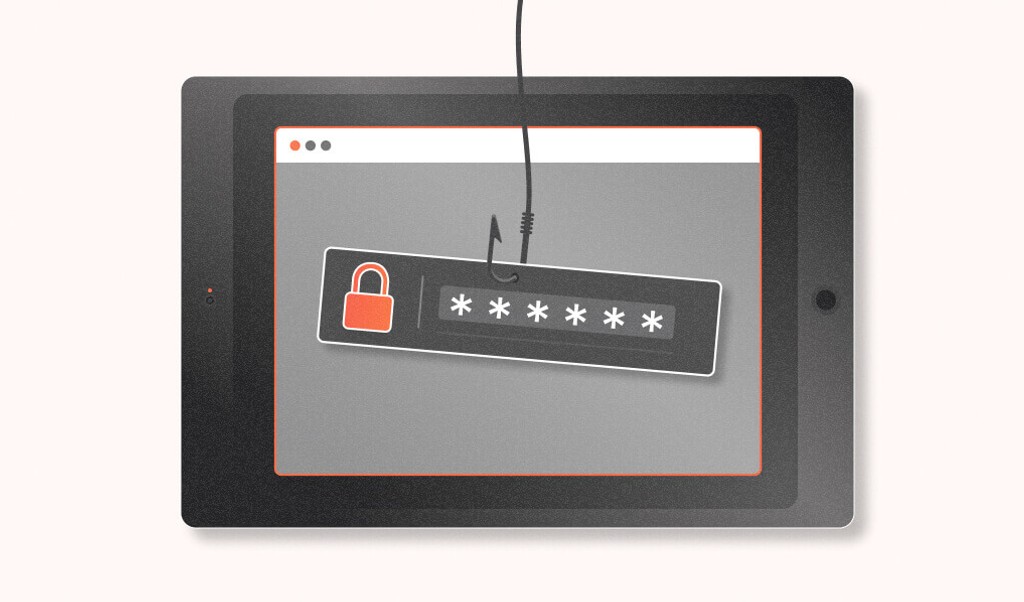

Phishing

Phishing attacks are like digital disguises. Fraudsters pretend to be legitimate companies or people you know to trick you into sharing sensitive information like usernames, passwords, or credit card details. They usually use email but also leverage fishy texts and fake websites. These deceptive messages are often carefully crafted to look like communications from trusted sources, making them particularly effective.

Credential stuffing

With credential stuffing, fraudsters take stolen login details from one data breach and try it on multiple other sites. This is why reusing passwords is a bad practice. Fraudsters are betting that many people use the same username and password across multiple services. This common security oversight allows fraudsters to potentially unlock a series of accounts with just one set of credentials, compounding the damage and increasing their chances of successful account takeovers across multiple platforms without any extra effort.

Malware

Malicious software, like viruses, worms, and Trojans, can spy on your keystrokes, steal passwords, or sneak into your system and gain total control. This versatility allows fraudsters to deploy a range of attacks depending on their specific objectives, whether quietly gathering confidential information over time or causing an immediate disruption. Malware's multi-functionality makes it a strong threat, as it can be adapted to exploit vulnerabilities in both personal and corporate environments.

SIM swapping

With SIM swapping, fraudsters trick your phone carrier into giving them control of your number. Once they have control, they can intercept your two-factor authentication (2FA) codes and waltz right into your accounts. This tactic not only gives attackers access to any account that uses SMS-based authentication but also compromises personal communications, including private messages and potentially sensitive business information. Once they control your phone number, the attackers can effectively impersonate you, further manipulating services and contacts to their advantage.

Man-in-the-middle (MTM) attacks

Picture a digital eavesdropper butting into your online conversations, snooping on, or altering what you send and receive. By inserting themselves into the data stream between you and a trusted service, man-in-the-middle attackers can capture sensitive information such as credit card numbers, personal messages, or login credentials. Additionally, they can manipulate the data being exchanged, like falsifying instructions or information, which can have dire consequences without either party realizing it until much later.

Social engineering

Social engineering describes when fraudsters use psychological tricks to make you spill secrets or break security rules. It's not about technical skills but manipulating people into making voluntary mistakes. Fraudsters may pose as authority figures or trusted colleagues, creating scenarios that provoke urgency or fear, compelling you to act quickly without pausing to verify the facts.

Brute force attacks

Sometimes, fraudsters just guess. A lot. They use automated programs to rapidly try countless passwords, hoping to stumble upon the right one. It's basic but can work if your password is weak or your account lacks strong protection. This brute force approach is particularly effective against accounts that do not use robust security measures like account lockout policies or multi-factor authentication (MFA).

Real-world examples of ATOs

To truly grasp the impact of account takeover fraud, it helps to look at real-world incidents that show how these attacks unfold and their consequences. The following cases highlight significant breaches across various industries, shedding light on the vulnerabilities exploited and the repercussions for businesses and their customers.

TurboTax

In mid-2021, TurboTax users got a wake-up call about password security. Intuit, the company behind TurboTax, revealed that hackers had broken into some accounts using login information stolen from other sites. While only a tiny fraction of users were affected (about .0003%), the breach exposed sensitive data like Social Security numbers and financial details. Intuit acted quickly, locking down compromised accounts and offering free identity protection to affected users.

Uber

Uber faced a digital break-in in September 2022 that started with a single compromised account. The attackers used stolen credentials from the dark web for an external contractor's account. The contractor, bombarded with 2FA requests, eventually allowed access. From there, the attackers worked their way into Uber's internal systems, including G-Suite and Slack. While customer data and public-facing systems stayed safe, the attack prompted the company to beef up security, adding extra layers of protection.

Dunkin’ Donuts

Nearly 20,000 Dunkin' Donuts Perks accounts were compromised in 2015, exposing names, emails, and account details. Some customers even reported unauthorized purchases. However, Dunkin' didn’t share details about the breach until 2018, landing them in legal hot water. To settle the lawsuit, Dunkin' had to notify affected customers and refund unauthorized charges. The company scrambled to fix the damage, resetting passwords and beefing up security. However, trouble struck again in 2019, with another 300,000 accounts breached.

Marriott

The Marriott data breach, undetected from 2014 to 2018, affected up to 500 million guests. It targeted a reservation system that Marriott had acquired in 2016, underlining the importance of post-acquisition security reviews. Exposed data included personal details, passport numbers, and encrypted payment information. Marriott's response included setting up support channels and offering free monitoring services. The attack lead to multiple lawsuits and a $23.8 million GDPR fine.

Snowflake

In the spring of 2024, cloud provider Snowflake fell victim to an account takeover attack. Attackers used stolen passwords to break into 165 customer accounts, including well-known companies like Advance Auto Parts and Ticketmaster. These accounts did not enable MFA and used stale passwords that had not been rotated for a long time. The attackers wielded specialized tools to query Snowflake's systems, exposing weak spots in cloud security. The full impact of this attack is still being discovered.

Electronic Arts

Gaming giant EA got hit in June 2021 when hackers swiped 780GB of data, including source code for the game FIFA 21. The breach started small: The attackers bought stolen Slack cookies on the dark web, then posed as an EA employee who had "lost their phone." An IT admin fell for the act and handed over a login token, unknowingly giving the hackers the keys to EA's kingdom. While the initial goal wasn't account takeover, it was the first domino in a much bigger data heist.

What is the best way to protect against ATO fraud?

Guarding against account takeover fraud requires a multi-layered approach. Companies can implement several strategies to protect their users:

- Require MFA for all accounts, which adds an additional security layer that requires a second form of verification beyond the password. It's like adding a second lock to your digital front door.

- Enforce fortress-like passwords that mix letters, numbers, and symbols, and require regular updates to prevent using outdated credentials.

- Regularly train users and employees to recognize phishing attempts and practice safe online habits, enhancing their ability to identify and react to suspicious communications.

- Use advanced analytics to monitor login patterns and behaviors, raising the alarm for activities that deviate from the norm, such as logins from new locations or at unusual times.

- Set policies to lock accounts after several failed login attempts to thwart brute force attacks and unauthorized access.

- Implement secure session management practices to prevent hijacking. Techniques like secure cookies, setting session expirations, and validating session tokens keep user sessions as secure as a vault.

Prevent account takeover fraud with Fingerprint

While the above measures form a solid foundation, dedicated fraud detection tools can provide an additional, crucial layer of protection. Fingerprint is a device intelligence platform designed to prevent fraud by analyzing device and browser attributes to generate unique visitor identifiers. This highly accurate recognition of visitors acts like a digital bouncer, enabling you to detect anomalies and identify fraudulent activities like account takeovers.

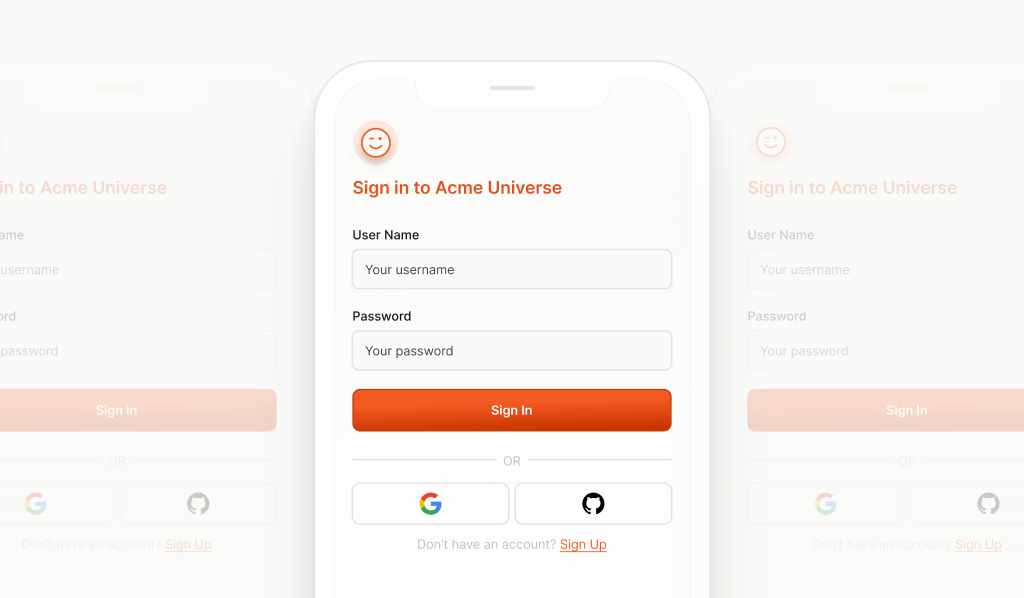

When a user attempts to log in, businesses can compare Fingerprint's visitor ID to determine if the login is coming from an unknown device. At this point, you can introduce additional hurdles to the login process, such as sending a one-time password (OTP). However, since you can also recognize legitimate users with Fingerprint visitor IDs, this extra step only needs to be applied when suspicious activity is detected, maintaining a buttery smooth user experience for most interactions.

Furthermore, Fingerprint provides over 20 Smart Signals that give valuable insights about your visitors' devices, such as detecting VPN usage, browser tampering, or bot activity. This additional information can help you make smart data-driven decisions and detect suspicious activity in real time.

By integrating Fingerprint, companies can detect login attempts from new devices or unusual locations, identify suspicious patterns in user behavior, and enhance authentication processes without disrupting the user experience.

With Fingerprint, you're not just blocking fraudsters — you're rolling out the red carpet for legitimate users so they have a seamless and secure online experience. It's the perfect balance of robust security and optimal user convenience, making Fingerprint a valuable asset in the fight against account takeover fraud.

Interested in improving your fraud detection with Fingerprint?

To discover more about how our platform can fortify your defenses against account takeovers, start a free trial today!

FAQ

Account takeover (ATO) fraud occurs when a fraudster gains unauthorized access to a user's account using stolen login credentials. This can lead to fraudulent transactions, data theft, and significant personal and financial harm.

Common methods include phishing, where attackers trick users into giving up personal information; credential stuffing, using breached data to access other accounts; malware, which can capture user credentials; and exploiting weak authentication practices.

Businesses can protect against account takeover by implementing multi-factor authentication, educating employees and customers about phishing threats, using strong password policies, and employing advanced security solutions like device intelligence to monitor and prevent unauthorized access.