Summarize this article with

SIM swapping attacks are a favorite move for fraudsters who want to bypass passwords and take over accounts. The U.S. Federal Communications Commission (FCC) receives thousands of complaints about SIM swapping every year, and the financial fallout from these attacks is significant.

If you’re responsible for user authentication or fraud prevention, learning how to prevent SIM swapping attacks is now table stakes. Let’s break down how SIM swapping works, why SMS-based authentication is an easy target, and which technical strategies actually make a difference.

What is SIM swapping and how does it work?

SIM swapping — also called SIM hijacking or phone porting fraud — is a social engineering attack targeting the process mobile carriers use to transfer phone numbers between SIM cards. Instead of hacking your password, fraudsters trick customer service representatives into moving your phone number to a SIM card they control. Once successful, attackers intercept two-factor authentication codes, reset passwords, and access financial, email, and social media accounts.

Here’s the typical SIM swapping playbook:

- Information gathering: Fraudsters collect personal details about the target, like names, addresses, account numbers, or answers to security questions. They scrape social media, use phishing, or buy data from shady marketplaces.

- Social engineering: Armed with this intel, the attacker contacts the mobile carrier, pretends to be the account holder, and claims their phone was lost or stolen. They request a SIM swap to a new device.

- Number takeover: If the carrier’s rep falls for the ruse, the attacker’s SIM card is activated with the victim’s number. The victim’s real phone loses service, and the attacker now receives all calls and texts.

- Account access: With the number in hand, attackers intercept SMS-based two-factor authentication codes, reset passwords, and gain access to high-value accounts.

If an account relies on SMS for authentication or recovery, it’s game over once the attacker controls the number.

Why SIM swapping is a major account takeover risk

SIM swapping is a staple of account takeover fraud because it bypasses passwords and targets the “secure” second factor: your phone number. When a fraudster controls the number, they can:

- Reset passwords using SMS recovery links

- Approve unauthorized transactions

- Lock out the legitimate user

- Drain financial accounts or steal digital assets

The result? Financial loss, angry users, and a bruised reputation for any business relying on SMS-based authentication. High-value targets include cryptocurrency wallets, online banking, and business email accounts.

Why SMS-based 2FA fails against SIM swapping

SMS-based two-factor authentication is weak. Here’s why fraudsters love it:

- Easy to exploit carrier processes: Customer service reps are trained to help, not to interrogate. Social engineering often works.

- No physical possession needed: Attackers just need your number, not your phone.

- Invisible to victims: Most people don’t notice their phone service is down until it’s too late.

- SMS is insecure: Messages can be intercepted or redirected, and numbers are easy to transfer.

Even the National Institute of Standards and Technology (NIST) warns against using SMS for two-factor authentication in sensitive applications. Yet, many organizations stick with SMS because it’s easy to implement and familiar.

Technical strategies to prevent SIM swapping

If you want to stop SIM swapping and protect your customers, you need to move beyond SMS and build a layered defense. Here’s how:

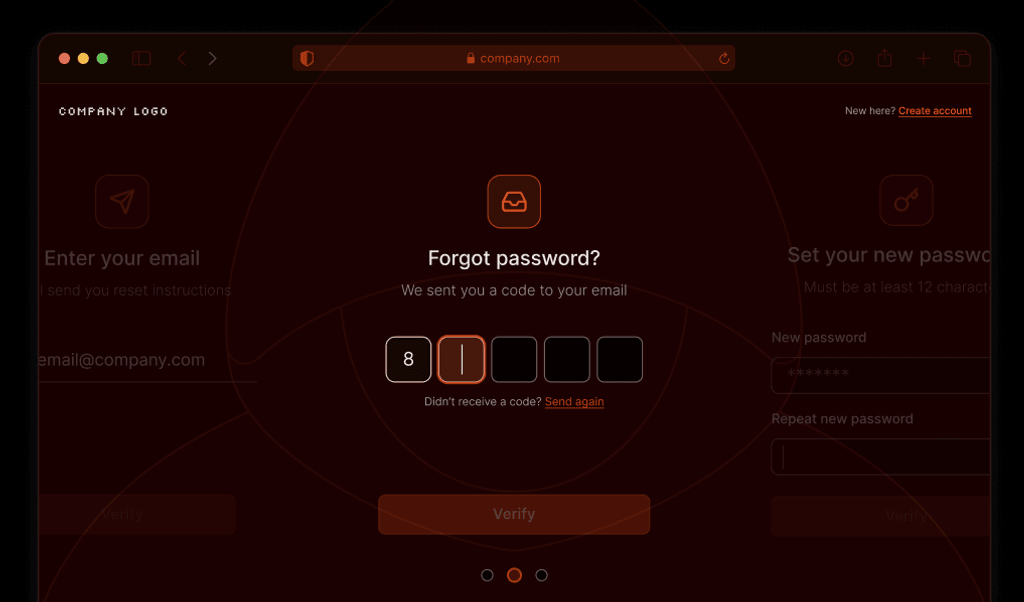

1. Replace SMS with stronger authentication

- App-based authenticators: Use time-based one-time passwords (TOTP) from apps like Google Authenticator or Authy. These codes are tied to the device, not the phone number, so SIM swaps don’t matter.

- Push notifications: Approve logins through secure app notifications instead of SMS. This keeps the authentication channel under your control.

- Hardware security keys: FIDO2/WebAuthn tokens require a physical device for authentication, making remote attacks nearly impossible.

2. Device Intelligence: Persistent identification beyond SIM cards

As we’ve seen, attackers can steal numbers, but stealing a unique device fingerprint is much harder.

Fingerprint provides device intelligence that uses 100+ signals to generate a persistent identifier for every visitor. This visitor ID remains stable even if the SIM card changes, cookies are cleared, or the IP address is different. By focusing on the device and not just the phone number, you get a clearer picture of who’s really accessing the account.

How does this help with SIM swapping?

- Device recognition: If a login comes from a device that’s never been seen before, even if the phone number matches, you can trigger additional verification.

- Behavioral analysis: Track how devices interact with your application over time. Sudden changes, like a new device associated with the same number, could be a red flag.

- Risk assessment: Combine device intelligence with other signals to assign a risk score to each authentication attempt.

Fraud teams can spot suspicious activity that would go unnoticed when only phone numbers are monitored.

3. Multi-layered authentication controls

- Step-up authentication: Require extra checks, like email verification or biometric approval, for high-risk actions or when a new device is detected.

- Device binding: Associate user accounts with specific trusted devices and require extra verification for new devices.

- Geolocation verification: Flag authentication attempts from unusual locations, especially when combined with device changes.

4. Carrier-level security

While you can’t control carrier processes, you can encourage users to protect themselves:

- Carrier PINs: Set additional PINs or passwords for account changes.

- Port freeze: Use carrier services that block number transfers without extra verification.

- Account alerts: Enable notifications for account changes or SIM swaps.

Smart Signals: real-time risk detection

Device identification is just the start. To catch SIM swapping and mobile identity fraud as it happens, you need real-time risk signals.

Fingerprint provides 20+ Smart Signals to flag risky activity, including:

- VPN Detection: Identifies when authentication attempts come from a virtual private network (VPN), often used by fraudsters to hide their true location.

- Bot Detection: Detects automated browsers and scripts used to test stolen credentials or automate fraud. This detection runs in the background — no annoying CAPTCHAs.

- Virtual Machine and Emulator Detection: Spots when an app or browser is running in a virtual machine or Android emulator, classic tools for large-scale attacks.

- Velocity Signals: Detects when a single device is suddenly associated with many different accounts, IP addresses, or countries in a short time frame.

- Browser Tampering Detection: Flags anti-detect browsers or manual configuration changes that indicate attempts to avoid identification.

You can combine these signals to build more robust authentication flows. For example, if you see a login from a new device using a VPN, coming from a suspicious IP, it’s time to step up authentication or block the attempt.

Implementation best practices

For development teams

- Audit authentication flows: Identify where SMS is used and plan to migrate to more secure alternatives.

- Progressive enhancement: Gradually introduce stronger authentication methods while maintaining backward compatibility.

- Monitor authentication patterns: Log and analyze authentication attempts for signs of SIM swapping.

For security teams

- Risk-based authentication: Evaluate multiple risk factors, not just SMS verification.

- Incident response planning: Have clear procedures for responding to suspected SIM swapping attacks.

- User communication: Educate users about authentication security and SIM swapping risks.

The bottom line

SIM swapping is here to stay, and SMS-based authentication isn't enough to stop it. Preventing SIM swapping fraud means building a layered defense: strong authentication, persistent device intelligence, real-time risk signals, and user education.

The key lesson: treat phone numbers as just one piece of the puzzle, not the master key. With device intelligence and Smart Signals, you can make SIM swapping a headache for attackers — and a non-issue for your users. Want to learn more? Start a free trial today and test out Fingerprint for yourself.

Ready to solve your biggest fraud challenges?

Install our JS agent on your website to uniquely identify the browsers that visit it.

![[Tutorial] What Is SMS Fraud? How to Detect and Prevent SMS Pumping Fraud [Tutorial] What Is SMS Fraud? How to Detect and Prevent SMS Pumping Fraud](/static/3bcefa86adfb1f403f6a5d349047275b/49159/blog_sms_fraud_tutorial.png)