Summarize this article with

What do you call it when a customer buys something from you, uses it without issue, and then disputes the charge to get their money back? That’s friendly fraud — and there’s nothing friendly about it. It’s also known as chargeback abuse or first-party fraud, but the outcome is the same. Suddenly, you’ve lost the revenue along with the product or service purchased, and you’ve gained the gift of chargeback fees, operational headaches, and a potential slap on the wrist from your payment processor or payment networks.

Chargebacks are meant to be a consumer safety net, but some people have turned them into their personal “get anything for free” card. This fraud comes in many flavors — like pretending a product wasn’t delivered or falsely claiming it’s defective. But the go-to excuse? “Unauthorized purchase.”

To catch these fibbers you need proof. Rock-solid evidence that ties the contested charge to the same device that happily made previous, undisputed purchases. Unfortunately, basic data points like user accounts or shipping addresses are easily manipulated and not strong enough to prove abuse. That’s why card networks like Visa and Mastercard now require merchants to provide device identity data in order to dispute a chargeback they think is fraudulent. In this article, I’ll show you how to use device data to expose friendly fraud and keep your hard-earned money where it belongs.

Common examples of friendly fraud

Friendly fraud is a type of first-party fraud where the fraudster doesn’t bother with fake identities — they act as themselves, claiming innocence while disputing legitimate charges. At its heart, friendly fraud thrives on plausible deniability, banking on the idea that customers are automatically seen as honest. Some of the classic flavors of friendly fraud include:

- Unauthorized purchase excuse: The customer plays the blame game, claiming, “It wasn’t me; it must’ve been a hacker.”

- Claiming non-delivery: “What package?” they say, conveniently forgetting the one sitting on their doorstep or already unboxed and in use.

- Fake dissatisfaction: “It was broken,” they claim while happily using their perfectly functional product.

- Subscription denial: “I never signed up for this!” they protest, conveniently ignoring that they did and forgot to cancel before the renewal.

- Double refunds: They go for the double-dip by asking for a refund and disputing the charge at the same time, treating themselves to a two-for-one deal.

- Forgetful spending: “What’s this charge?” they ask, completely blanking on their late-night shopping spree or their kid’s virtual currency splurge.

- Buy now, regret later: That impulse purchase they just had to have last week no longer sparks joy, but they skip the refund process and go straight to a dispute.

A billion-dollar headache

Friendly fraud is a major problem for businesses, racking up over $100 billion in losses every year. While chargebacks can be legitimate when an account is actually compromised, a staggering 75% of them are estimated to be friendly fraud. Even more frustrating, 35% of people openly admit to doing it.

It’s important to distinguish between chargebacks and refund requests. A refund request goes directly through the merchant, giving them a chance to resolve issues amicably without penalties. A chargeback, on the other hand, is initiated through the customer’s bank, bypassing the merchant entirely, and resulting in financial and reputational consequences.

Chargeback fees can range between $15 and $100+ depending on the processor, network, and the merchant’s history. Add the cost of investigating and disputing them, and you’re looking at even more lost revenue.

Banks often side with customers, seeing charge disputes as consumer protection, leaving merchants struggling to defend themselves. To effectively combat this type of fraud, merchants need indisputable proof that directly ties the customer to the transaction. This is where device identification solutions like Fingerprint can make all the difference.

Introducing Fingerprint

Fingerprint Identification is a powerful device recognition solution that uniquely identifies browsers and devices with industry-leading precision. It works by analyzing a wide range of device attributes, including operating system details, installed fonts, screen resolution, browser version, and other subtle characteristics. These data points are like puzzle pieces, and when combined with advanced server-side techniques and machine learning, they create a persistent, unique identifier that’s nearly impossible to manipulate.

Unlike traditional visitor recognition methods that rely on cookies, IP addresses, or simple metadata, Fingerprint uses hard-to-fake signals. The result is an identifier that stays consistent with a browser or device, even when users attempt to obscure their activity by clearing cookies, activating a VPN, or browsing in incognito mode.

How visitor IDs strengthen your case

Fingerprint visitor IDs provide the evidence merchants need to fight fraudulent chargebacks by linking a customer’s device to a specific transaction, offering clear proof that they made the purchase. They can be used to identify shopping patterns, effectively dismantling the “It wasn’t me” excuse with consistent, accurate, and reliable data.

Consider this common scenario: A customer disputes a purchase, claiming they never made it. But when their visitor ID matches perfectly with the one used for past legitimate transactions, their argument falls apart. Or take the case of repeat anonymous offenders: Guest checkouts can increase conversions but make linking fraudulent purchases much harder. Fingerprint visitor identification can help merchants spot a pattern of disputes coming from the same device and allow them to take meaningful action even without the user ever logging in.

Practical steps for catching first-party fraudsters

Catching first-party fraudsters doesn’t have to feel like detective work. With Fingerprint visitor IDs, you can easily tie fraudulent claims directly back to the device behind them. Here’s how to set up your fraud-fighting process:

Install Fingerprint

Begin by adding the Fingerprint client agent to your purchase pages to ensure each visitor gets their own unique visitor ID. It’s lightweight, simple to set up, and comes in over 15 flavors for your favorite frameworks and languages. Here’s an example of how you can include it in an order processing workflow.

// Initialize the agent once at web application startup.

const fpPromise = import('https://fpjscdn.net/v3/PUBLIC_API_KEY')

.then(FingerprintJS => FingerprintJS.load())

async function placeOrder(orderDetails) {

// Get the visitor ID when you need it.

const fp = await fpPromise;

const result = await fp.get();

const { requestId } = result;

// Include the visitor ID with the order details.

const orderPayload = {

...orderDetails,

requestId: result.requestId,

};

const requestOptions = {

method: "POST",

body: JSON.stringify(orderPayload),

headers: {

"Content-Type": "application/json",

Accept: "application/json",

},

};

// Send the order payload to your server.

const response = await fetch("/api/place-order", requestOptions);

// ... additional order logic

}On your server, you can access the visitor ID from the identification request, along with additional insights such as VPN usage or browser tampering provided by our Smart Signals. To learn more about getting visitor identification on the server-side, view our documentation.

Record visitor IDs with purchase data

When a customer makes a purchase, pair their visitor ID with important details like their account, transaction ID, payment method, shipping address, etc. Think of it as creating a digital fingerprint for every transaction.

const query = `

INSERT INTO transactions (visitor_id, account_id, transaction_id,

payment_method, shipping_address, purchase_date)

VALUES (?, ?, ?, ?, ?, ?)`;

const values = [

visitorId, // Retrieved from Fingerprint via API or server client.

accountId,

transactionId,

paymentMethod,

shippingAddress,

purchaseDate,

];

await db.execute(query, values);Build a device activity profile

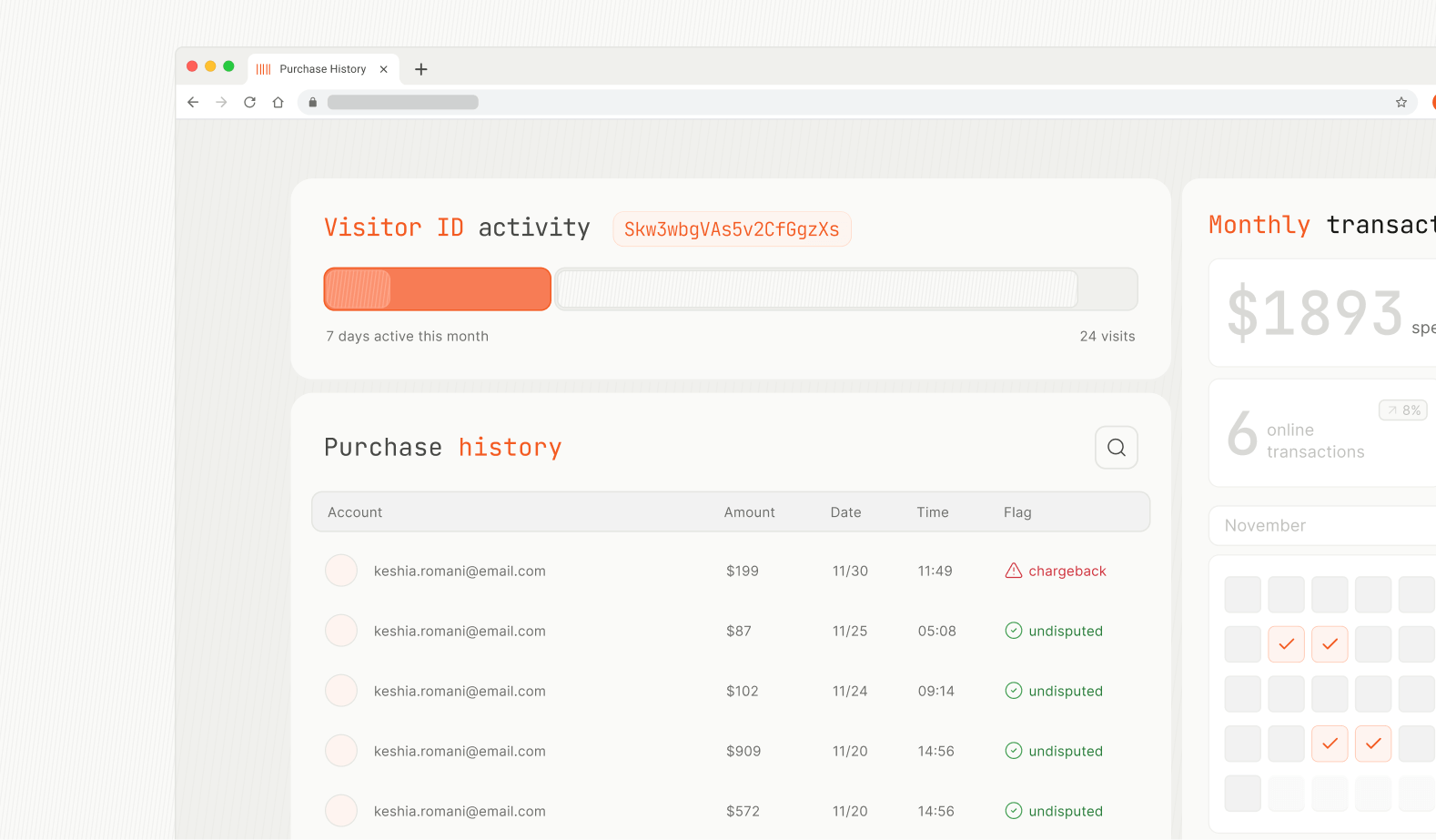

Run a query to compile a device activity profile that shows a history of their interactions, like legitimate account logins, successful purchases, and undisputed transactions, all tied to the same visitor ID.

const query = `

SELECT

transaction_id, account_id, purchase_date, payment_method, shipping_address

FROM transactions

WHERE visitor_id = ?

ORDER BY purchase_date DESC`;

const values = [visitorId];

const [rows] = await db.execute(query, values);Include historical visitor ID data in disputes

Submit your chargeback dispute report, including the visitor ID, to your payment processor or network to demonstrate the presence of friendly fraud.

Turn the tables on first-party fraud

Fighting friendly fraud doesn’t have to be a costly headache. With billions lost every year and chargebacks piling up, it’s clear that traditional methods for tackling friendly fraud just don’t make the cut anymore.

Fingerprint offers a reliable, easy-to-implement device identification solution that just works. It’s reliable, persistent, and gives you the upper hand, helping you build airtight cases against fraudsters.

Want to see how Fingerprint can help you shut down chargeback abuse? Start a free trial or reach out for one-on-one implementation guidance. The fraudsters won’t know what hit them.