Payment fraud Articles

November 25, 2025

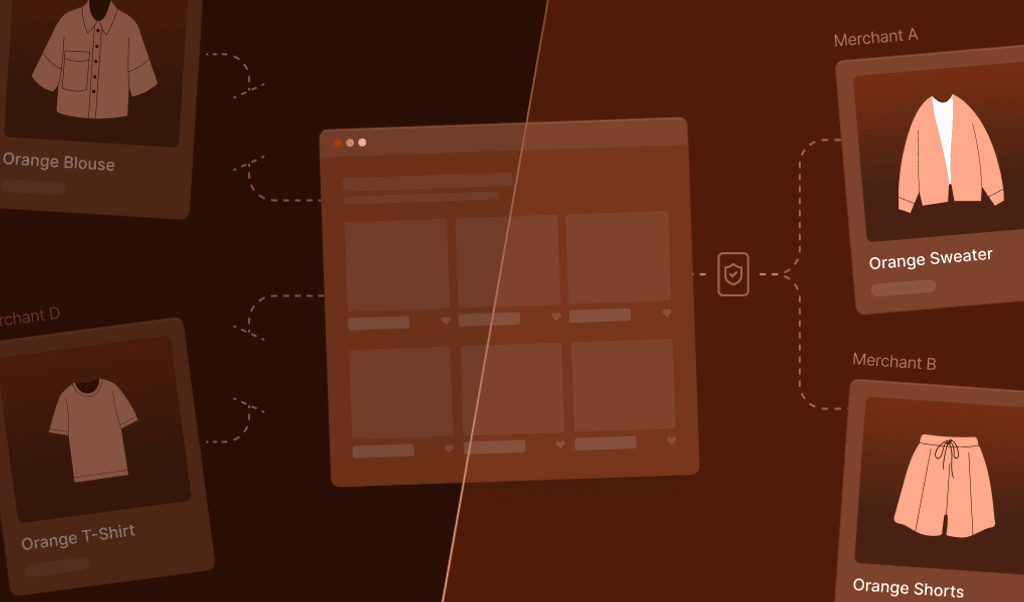

How e-commerce platforms can build stronger fraud prevention at global scale

Learn how e-commerce platforms can help merchants cut fraud, reduce chargebacks, and boost conversions by embedding real-time device intelligence into checkout flows.

- Fingerprinting

- Ecommerce fraud

- Payment fraud

October 17, 2025

Balancing growth & trust: Fraud risks facing e-commerce platforms in 2025

Digital commerce platforms must balance growth with trust. Discover how device intelligence reduces fraud and false declines while protecting merchant margins.

- Account takeover

- Payment fraud

- Anti Fraud technology

- Ecommerce fraud

June 27, 2025

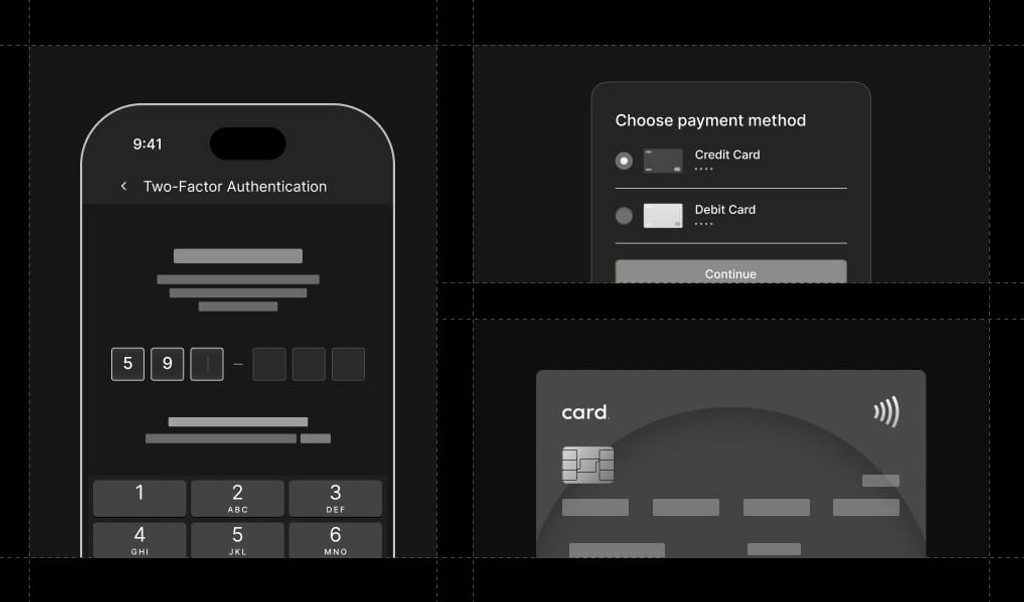

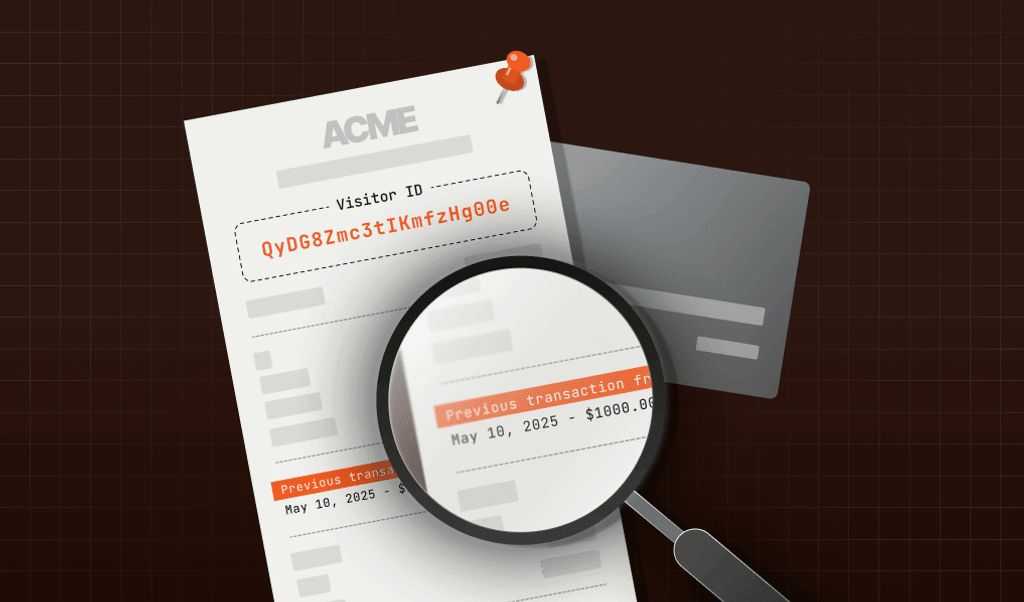

Guest checkout fraud: How to stop repeat offenders

Allowing guest checkouts boosts conversion rates but also opens the door to repeated anonymous payment fraud. Learn how to detect and stop fraudsters while maintaining a seamless experience for legitimate shoppers.

- Ecommerce fraud

- Payment fraud

- Tutorials